Friday Five: 1 headline, 1 quote, 1 framework, 1 teardown, and 1 question from the world of SaaS

Plus: Metronome's monetization operating model.

Welcome back to Good Better Best!

Big news over here at PricingSaaS HQ — today caps my first week working full-time on PricingSaaS 🎉

To celebrate, John and I held our first company offsite in Montreal, where we spent two days planning where to take the business in the short term and long term.

TLDR, we’re going to ramp up the resources. More reports, more swipe files with examples, and more frameworks that will help operators stay up to speed as the SaaS landscape continues evolving. If you are a company or creator in the space, and want to collaborate with us, shoot me a note at rob@pricingsaas.com.

As you probably noticed, we’re testing out a new format this week. I love quick, structured newsletters (e.g., James Clear’s 3-2-1, Tim Ferriss’ 5-Bullet Friday) and have always wanted to give it a shot. If you have thoughts, let me know!

On to today’s post after a quick word from our sponsor, Metronome.

The New Operating Model Powering Modern Monetization

Solely seat based. AI native. Usage based. Hybrid structured. Product led.

Modern SaaS teams are shipping value faster than ever, but most are still pricing like it’s 2015. This whitepaper introduces the Monetization Operating Model: a strategic framework for aligning product, finance, and GTM around how value is delivered and captured. Learn how category leaders turn pricing into a growth engine, and how your team can, too.

1️⃣ Headline: Grammarly gets more interesting with Coda, Superhuman deals (Constellation Research)

Shishir Mehrotra might be the smartest person in the world when it comes to bundling, and he’s slowly acquiring his way to a fascinating productivity bundle.

To recap:

Grammarly acquired Coda, where Shishir was CEO

Grammarly named Shishir CEO of the combined company

Grammarly acquired Superhuman

TLDR, Grammarly, which on its own, might have been one of the most at-risk products in SaaS (ChatGPT can do spelling and grammar), now includes a collaborative workspace (Coda) and premium email solution (Superhuman).

As is, this is a compelling trio of productivity products. Adding to the intrigue is recent positioning around becoming an agentic productivity platform. Here’s Larry Dignan from Constellation Research:

The vision here is that the Grammarly platform will use AI agents to triage your inbox, schedule meetings, analyze your content and write full emails in your voice.

Coda always seemed a bit too complicated for me, but I’m a loyal Superhuman user. It’ll be interesting to see how Shishir and team bring bundle mechanics to the world of agents to build an AI-powered productivity suite.

For what its worth, it seems like they’re on a crash course with Notion, who acquired Cron, a smart calendar app, back in 2022, and recently released an email product.

2️⃣ Quote: Jamin Ball, “SaaS isn’t dead”

The future of SaaS is a hot topic, and I’ve heard compelling arguments on both sides. Thought this perspective from Jamin Ball over at Clouded Judement seemed sensible, especially this: software has a long half-life, and rarely dies overnight. Read the full quote below 👇

My view hasn’t changed: software will have to evolve, but it’s certainly not dead. Business models will shift. Orgs will need to adapt. But the core idea of building a product, shipping it broadly, evolving it, and capturing value through usage isn’t going away. We’ve been here before. The rise of the cloud was supposed to spell the end for on-prem software. It didn’t. On-prem didn’t disappear, there are still plenty of on prem software companies and deployments today! Software has a long half-life and rarely dies overnight. The durability comes from more than just the “record” in a system of record. The real value is in the workflows that touch it. Those workflows can number in the hundreds, spreading into sales, finance, support, billing, compliance, and a tangle of custom tools. These tentacles are difficult to replace, and companies are hesitant to try. Break one connection and you risk customer-facing impact, which is not a gamble most teams want to take.

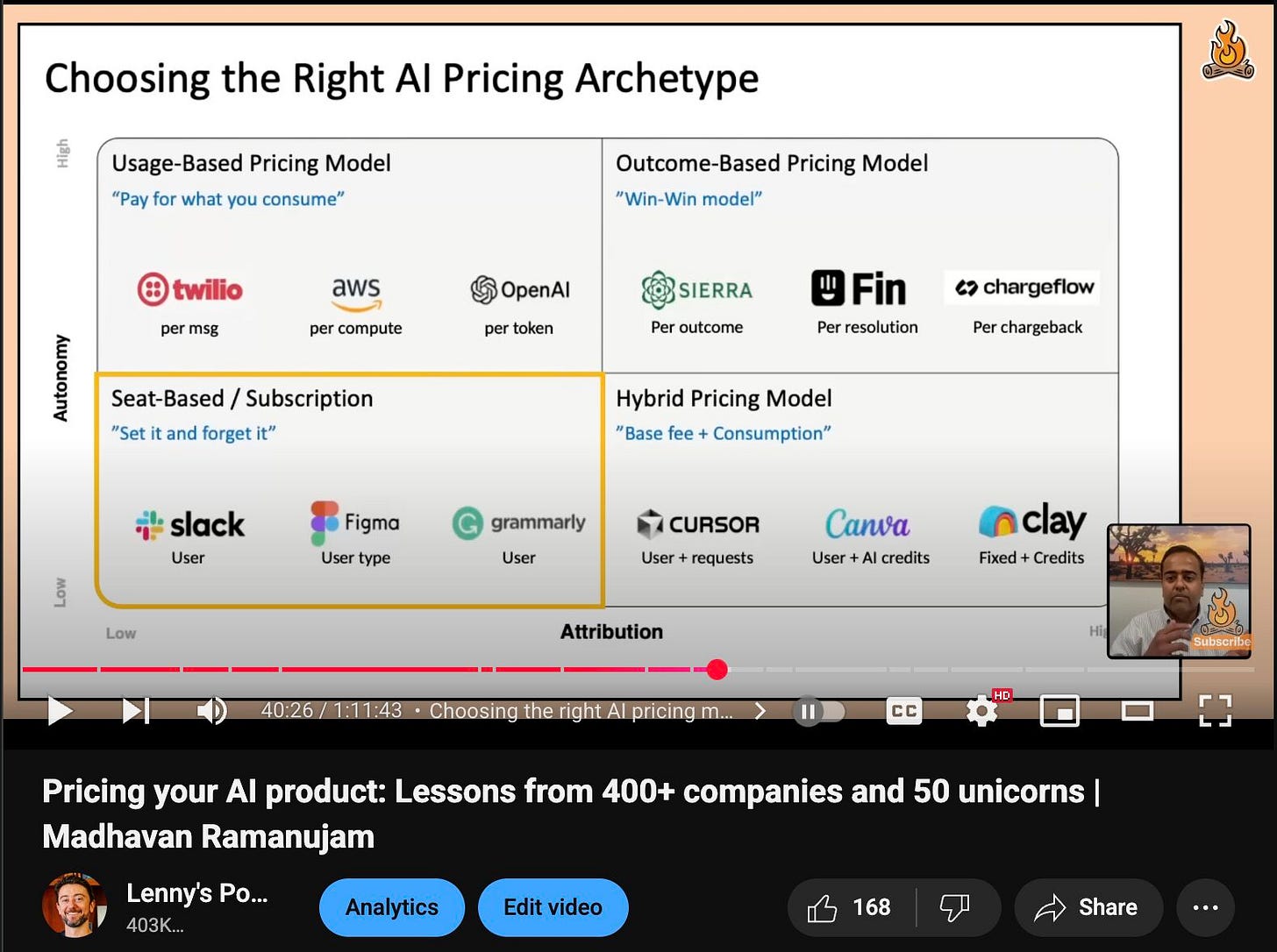

3️⃣ Framework: The Madvahan Matrix

I’m a sucker for a good 2x2 and this one from Madhavan Ramanujam is a gem:

On one axis, you have autonomy: The question here is whether your product is a copilot or truly powers itself.

On the other, you have attribution: This comes down to how much you can prove the value that you bring to the table.

It’s rare you find a grid like this that allows you to map pretty much any company. Also love that it makes a case for all of the most popular pricing models, including seats (sometimes it makes sense!).

4️⃣ Teardown: Figma Make vs Lovable

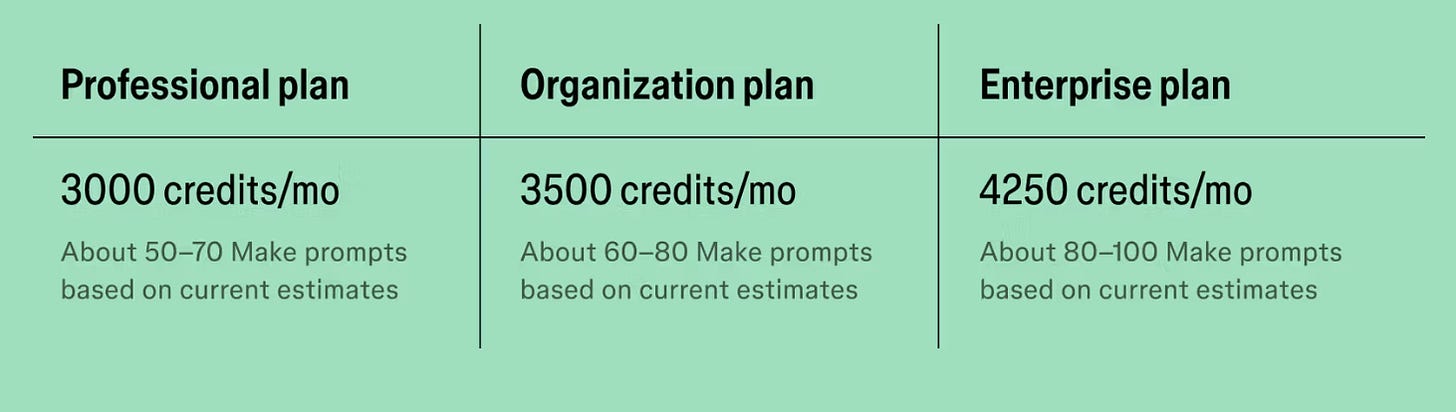

Figma recently launched a new product called Figma Make to compete with Lovable and other vibe-coding tools. After pushing Figma Make and a few other AI features into GA, Figma announced monthly credit limits across all AI tools.

They also teased changes that will roll out later this year, including the ability to purchase additional AI credits for power users and lower credit limits for users with View, Collab, and Dev seats.

Notably, for the time being Figma says they won’t be strictly enforcing credit limits for Full seats (they are historically generous in the early days of a product launch. In 2021, they offered FigJam free for the first year).

Despite the early generosity, this model is objectively more complex than Lovable, which allows you to see usage in real-time directly from your dashboard, charges a single credit regardless of prompt complexity, and offers flexible credit rollovers.

With that in mind, I wouldn’t expect Figma Make to be a massive driver of net new customers, but it (along with Figma’s other AI releases) should be a solid retention play that will drive account expansion.

5️⃣ Question: How do you define an AI company?

A month ago, I caught up with Kyle Poyar, and he made it a point to differentiate between SaaS and AI companies.

Until that moment, I hadn’t given much thought to the difference. I figured most of the companies I cover are both: maybe some are SaaS companies that embrace AI (e.g., HubSpot), and others are AI companies that use a SaaS model (e.g., Lovable).

But his distinction between the two rattled me a bit. John and I immediately went out and purchased pricingai.com just in case we need a backup plan 😂

Naturally, ChatGPT offered a simple heuristic to tell the difference:

If you remove the AI, does the company still exist as valuable software?

If yes → it’s SaaS with AI features.

If no → it’s an AI company.

I’d love to get your perspective. Is this spot on? Off base? Anything you would add?

Let me know and I’ll publish an update next week.

Thanks for reading! When you’re ready, here’s how we can help:

PricingSaaS Community: Join the free PricingSaaS Community to get quick answers from experts, real-time pricing data, and access to exclusive events.

PricingSaaS Index: Check out the PricingSaaS Index to track competitors, scroll pricing histories, and create a swipe file of pricing pages for inspiration.

Free Advisory Session: Need a sounding board? Book a 30-minute session. No sales pitch. We’ll provide honest feedback and steer you in the right direction.

Really clear breakdown. What’s fascinating is how serverless feels almost ‘scripted automation for business logic’......you rent not just resources, but pre-written efficiency.

Great that you met in Montreal. That is where I grew up. Note on Lovable "charges a single credit regardless of prompt complexity" This is no longer true, Lovable now charges by prompt complexity and even charges fractions of a credit! At Ibbaka we are heavy Lovable users. It also really annoys me that I cannot buy ad-hoc credits on Lovable. We frequently are a few credits short by the end of the month, but not always, and not enough to makes us want to go up to the next tier. There is a lot of work to be done on credit based pricing systems and best practices to be established.