How Okta’s New Tiered Pricing Model Drives Growth

Plus: Updates from Dropbox, Evernote, and Rivery.

Welcome back to Good Better Best!

Today, we’re breaking down Okta’s recent shift from a-la-carte to a tiered pricing model. Before we get there, a couple upcoming events from PricingSaaS:

➡️ April 24th: PricingSaaS AI Credits Report: Later this month, we’ll be publishing a report on AI pricing and Credit Models. We want to hear from you. Which companies are offering best-in-class AI pricing and Credit models? Let us know in the comments.

➡️ April 28th: AMA with Sam Lee: Sam’s led pricing at ServiceNow, Snowflake, and now HubSpot - some of the biggest names in SaaS. He’s also one of the most thoughtful people I’ve met, and a true joy to talk pricing with. Join the PricingSaaS Community to submit questions and attend the live event.

On to this week’s post.

📰 Pricing News & Updates

Today’s Post is brought to you by Schematic — The monetization platform built for product & revenue teams.

Schematic gives product, growth, and sales teams the ability to:

Convert free trialers to paid accounts

Drive expansion with triggered paywalls and alerts

Launch & support any pricing model, from seats to credits

Support custom configuration for enterprise deals

Prevent churn with loyalty credits and discounts

All without pulling in engineering.

Inside Okta’s move from a-la-carte to Tiers

Last December, Okta CEO Todd McKinnon teased a simpler pricing model in Okta’s Q3 earnings call. When asked how he’s thinking about pricing and packaging going into 2025, he said the following:

We have a bunch of things we’re modeling out and experiments we’re doing. I think the main idea is our pricing right now is pretty a-la-carte and we’re looking at more additions or simplified pricing. We’re seeing good patterns of how people buy Good-Better-Best and we’re looking at options to make that easier for customers to consume.

I’ve been jokingly saying GBB is forever, regardless of where SaaS pricing goes. But it’s kinda true 😂

As you can see below, Okta’s previous pricing model was a-la-carte with an annual contract minimum of $1,500:

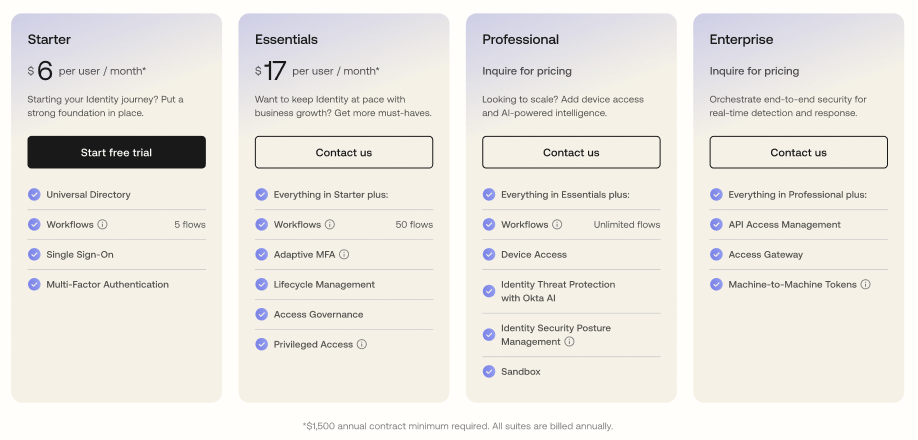

Last month, Okta followed through on McKinnon’s teaser, introducing a tiered strategy with four “Workforce Identity Suites.”

Here’s how they’re described in blog post announcement:

Workforce Identity Suites are designed to address crucial Identity security use cases necessary to thrive in the current threat landscape. They offer sets of critical capabilities that businesses often require based on their Identity challenges and maturity, meeting them where they are today while supporting their development over time.

Put simply, the new tiers are prescriptive. Each tier has a defined job-to-be-done tailored to a specific user — a clear pivot from the previous a-la-carte model.

There’s a lot to love about this move. Some immediate observations:

Easier Decision-Making: The tiered model is clear and easy to digest for the customer, which should lead to easier decisions — especially for SMBs.

Faster Sales Cycles: The tiered model should make life easier for sales reps, who can quickly prescribe the right solution for a new customer, which I’d expect to speed up the sales cycle, especially among downmarket customers.

Bundle Economics: Looking at the a-la-carte prices, both the Starter and Essentials plans offer discounts on the previous prices, incentivizing customers to choose the tiered approach.

Higher ACVs: Despite the bundle economics, I’d image the tiered approach will drive larger contracts by locking customers into more products than they otherwise would have purchased, and by introducing usage thresholds to drive expansion. For example, the Starter Tier has a limit of 5 workflows, which many customers will likely exceed, forcing an upgrade to the Essentials tier. Plus, the $1,500 annual contract minimum is still intact.

Flexible Options: There’s still room for custom agreements — both upmarket tiers offer custom pricing, and Okta still allows customers to purchase a-la-carte.

Overall, I’d characterize this move as a shift in defaults. While customers can still purchase a-la-carte, the first thing they see on the pricing page is the four core tiers, which offer a prescriptive solution based on the visitor’s use case and maturity. I’d imagine Okta has been selling these bundles informally for a while, which gave them confidence to make it the default setting.

Overall, it feels like a smart move that gives SMBs an easier entry point while maintaining a high-level of customization for Enterprise customers. Read on below for Ulrik’s take on the benefits of tiers over a-la-carte.

🎯 Expert Insight

While a-la-carte options offer flexibility, a well-designed tiered model is often superior for a number of strategic reasons.

Below, I’ve broken down some of the biggest reasons to make the shift.

To facilitate a "land-and-expand" strategy: Tiered models, particularly those with a "laddered structure," are designed to guide customers from an initial, smaller purchase to more expensive tiers over time. This encourages expansion revenue through product upgrades as the customer's needs grow and they see more value.

To better align packaging with "jobs to be done": Each tier in a well-designed model should solve a specific "job" for the customer, rather than just offering a collection of features. A-la-carte options might lead to selling individual "tools" without a clear focus on the complete job the customer needs to accomplish. Tiering around jobs makes it instantly clearer to the customer what they are buying and its intended outcome.

To simplify the choice architecture: Offering numerous modules and add-ons can create a complex choice architecture with a staggering number of potential combinations, which can be overwhelming for customers. Tiered packaging reduces the number of choices, making it easier for customers to understand their options and for the sales team to sell. For ACVs below $25K, this is especially important.

To improve CLTV/CAC ratio: By focusing on jobs to be done and facilitating expansion, tiered packaging can have a tremendous positive impact on the Customer Lifetime Value (CLTV) to Customer Acquisition Cost (CAC) ratio. Repackaging around jobs can lead to a reduction in CAC and an increase in Average Revenue Per Account (ARPA) due to less discounting.

To avoid becoming a "Hydra": An over-reliance on a-la-carte modules where every new functionality becomes an add-on can lead to a "Hydra" product – one that grows in complexity, potentially increasing the cost to serve without significant price adjustments for the added value within existing customer segments. Tiered models encourage incorporating new, enhancing features into existing job-focused tiers rather than always creating new modules.

To tell a more compelling story: A product ladder within a tiered model can tell a compelling story about the customer's journey and the increasing value they receive as they move up the tiers. This narrative is often harder to convey with a collection of independent modules. The higher tiers can even help sell the lower ones by showing the ultimate potential value.

To avoid the "uni-product" trap: Simply offering all features in a single, customizable package with negotiated pricing (essentially extreme a-la-carte) beyond the MVP stage is not recommended. Tiering provides structure and helps avoid undervaluing the product by allowing for price discrimination based on the value delivered by each tier.

In essence, the move from a-la-carte to tiered packaging is often driven by a strategic shift towards a more customer-centric approach focused on delivering solutions for specific jobs, fostering long-term customer value through a clear upgrade path, and achieving more favorable and scalable economics. For more, you might enjoy my webinar dedicated to SaaS packaging.

How we can help when you’re ready

Got questions? Join the free PricingSaaS Community to get fast answers from pricing leaders.

Leveling up? Check out our Resource Center for links to pricing and packaging research, webinars, and our free online course.

Need help? Our SaaS Pricing Assessment delivers a clear roadmap to smarter pricing and packaging in 30 days.