Price Testing 101 with Justin Farris (GitLab, Zillow)

Plus: 3 keys to successful discounting design.

Welcome back to Good Better Best!

This week, I’m sharing highlights from an awesome conversation with Justin Farris, VP Product at GitLab. Justin has a fascinating background, having worked on pricing at GitLab, and Zillow before that. Across those experiences, he’s developed a sharp perspective on price-testing, and it was a blast picking his brain.

First, a couple quick housekeeping items from our side:

John will be joining Wes Bush at ProductLed to break down strategies to turn free users into recurring revenue. The webinar is next Wednesday, June 25th.

Next week, we’re relaunching the PricingSaaS website with new, free tools for SaaS operators. Stay tuned and sign up now to make sure you don’t miss out.

On to this week’s post.

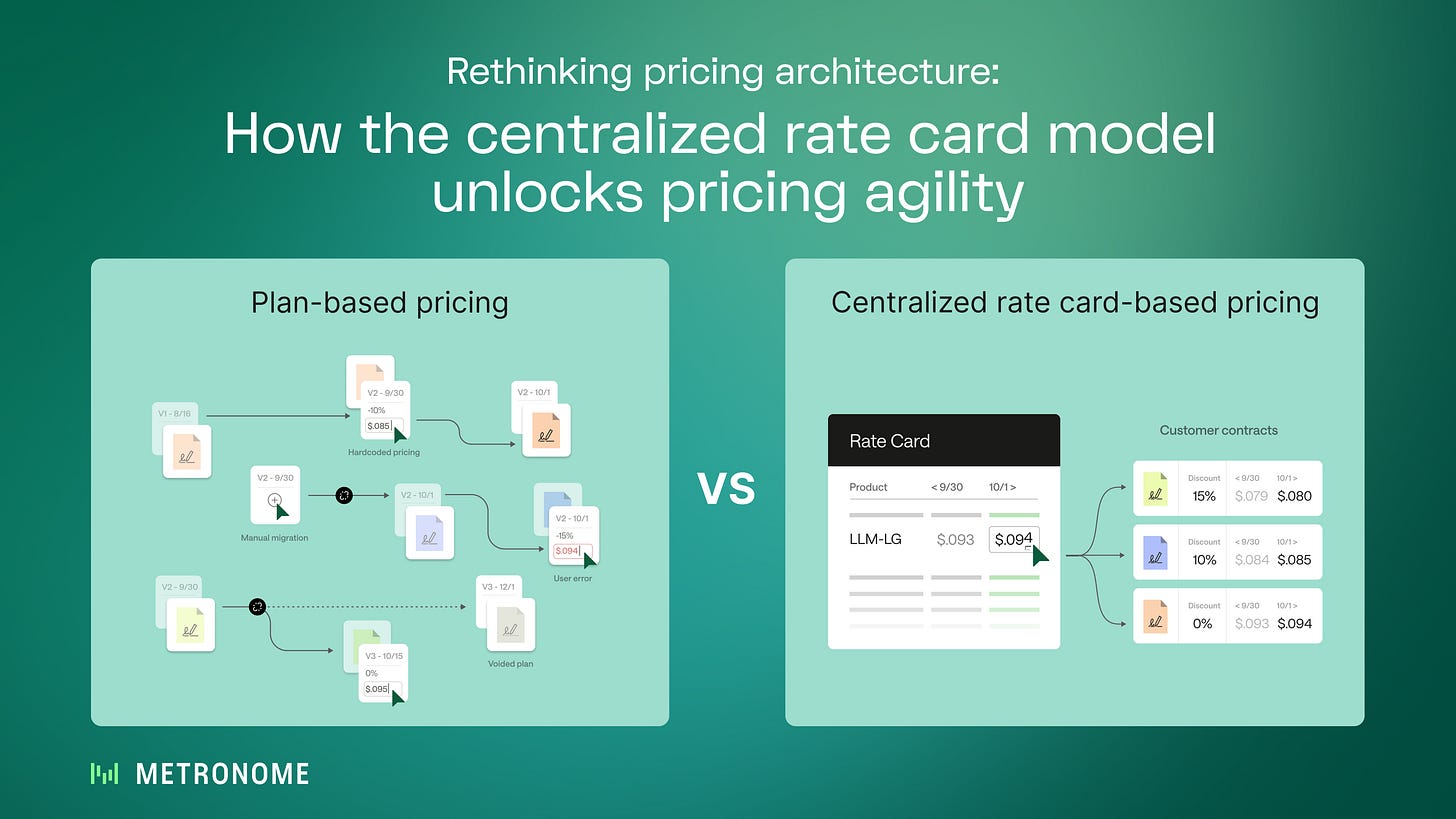

Why your pricing updates take months—and how to fix it

If changing a price means cloning plans and migrating customers, your billing system is slowing you down.

In this post, Metronome breaks down why legacy plan-based billing kills pricing agility—and how a centralized rate card model lets you launch updates as fast (and controlled) as you ship code. Faster changes, fewer errors, cleaner invoices.

A few weeks back, I caught up with Justin Farris, one of the smartest (and kindest) people I’ve met in SaaS pricing (shoutout Scott Woody for the intro 🙏🏼). Below are some of my favorite highlights from our conversation.

Rob: What’s your favorite approach to testing prices during product development?

Justin: It depends on the product. At Zillow, we had a price for every zip code in the country, so we could do true split-variant A/B tests. You’d test prices in neighboring zip codes—same market, different prices—and measure willingness to pay and elasticity at scale. Since Zillow’s primary business model is ad driven the end state resulted in market based pricing (aka “AdWords” bidding).

At GitLab, it’s a lot more qualitative. Traditional pricing studies are ideal, but you don’t always have the luxury of time or budget to run one. We’ll involve the pricing and PM teams in early sales calls, even before the product is fully launched. Enterprise customers often want to commit budget early, which gives us a chance to float pricing hypotheses—on packaging, pricing metrics, and price points—and learn fast. It’s not as clean as a formal pricing study, but it’s incredibly insightful. And it’s great for internal buy-in when you can play back real customer feedback.

Rob: So price points are more science, and packaging and metrics are more art?

Justin: You can apply science and art to both if you want—surveys, conjoint, Gabor-Granger, leader-filler-killer frameworks. But even then, you shouldn't do it alone. You need deep customer interviews alongside the data. Time and product maturity matter too. If you're under pressure to move fast, you may not have the luxury of a robust study. In that case, we often rely on limited availability testing: test pricing with small groups during a soft rollout. That’s especially helpful in AI pricing, where usage is fluid and unpredictable - and in general things are moving very very fast.

Rob: How do you get pricing insights from customers who are averse to talking about pricing? (e.g., they always lowball surveys or avoid pricing convos entirely.)

Justin: That’s a real challenge, especially in industries where the majority of the market is SMB or owner-operator, where buyers are small shops and always strapped for time. My advice: show up as a neutral third party. If you reach out to the company trying to sell them software, you’ll get worse responses. We’ve used tools like Office Hours to run interviews as a “market research firm” instead of GitLab. You get more honest, useful input that way.

If that doesn’t work, run live pricing experiments. Even if it’s slower, you’ll get signal when people are actually ready to buy.

Rob: Juicy one — what’s your take on A/B testing pricing?

Justin: I love it, but only when it makes sense. Zillow was perfect—we had 50,000+ SKUs and a lot of control. GitLab? Not so much. Because our pricing is fairly transparent worldwide, we couldn’t A/B test the $29/month Premium tier without exposing that experiment.

If you do try it on a B2B SaaS product and pricing is public, use GEO-based testing. For example, run one price in North America and a slightly different one in Western Europe — markets with similar characteristics. If your pricing isn’t super public, you have more flexibility.

Thanks again to Justin! Our next AMA is July 30th with Kyle Poyar — to follow along and drop questions, join the PricingSaaS Community.

🎯 Expert Perspective

Over the years, I've watched countless companies stumble through volume pricing conversations, often leaving substantial value on the table or, worse, eroding their margins in pursuit of that "big deal."

The pattern is predictable: a large prospect appears, negotiations intensify, and suddenly the pricing structure that worked for smaller customers feels inadequate, or gets thrown out entirely.

Through trial and error, I've learned that sustainable volume pricing isn't about reactive discounting. It's about creating a framework that serves both your business and your customers' need for predictability. Here are three principles that have transformed how I approach these conversations.

Create a Discount Slope

Companies should establish a predefined "discount slope" or rate of price changes related to volume. This prevents excessive discounts (e.g., 70% discounts on large cases) and maintains profitability.

Magnify the Scale

Design the structure to be "bigger" than current customers (target 4x your biggest customer). This allows larger customers to see where they fit within the model, leveling the playing field during negotiations.

Implement a Price Floor

The slope should eventually flatten out, signaling a price point below which discounts will not be offered, regardless of the opportunity size. This implies underlying cost dynamics that limit profitability below a certain level.

The beauty of this approach lies not in its complexity, but in its transparency. When prospects understand the logic behind your pricing structure, negotiations shift from adversarial to collaborative. You're no longer defending arbitrary numbers — you're explaining a system.

I'll admit, implementing this framework required some uncomfortable conversations with existing clients who had grown accustomed to ad hoc pricing discussions. But the long-term benefits—predictable margins, faster deal cycles, and healthier customer relationships—proved worth the initial friction.

The companies that thrive in volume pricing aren't necessarily those with the most sophisticated algorithms or the most aggressive discounts. They're the ones that understand pricing as a strategic communication tool, one that signals value while protecting the business fundamentals that make long-term partnerships possible.

PS. Next week, I’m hosting a webinar on subscription time periods (monthly, annual, multi-year). Join me to dive deeper into discounts and contract term strategy.

How we can help when you’re ready

Pricing questions? Join the free PricingSaaS Community to get fast answers from pricing leaders.

Looking to level up? Check out our Resource Center for links to pricing and packaging research, webinars, and our free online course.

Working on pricing? Our SaaS Pricing Assessment delivers a clear roadmap to smarter pricing and packaging in 30 days.