Pricing Retrospective: How Canva, Figma, and Adobe evolved their pricing

Plus: A full pricing retrospective to add to your swipe file.

Every week, we provide research and resources to help SaaS leaders make smarter pricing and packaging decisions. Sign up for free to stay ahead of the curve.

Good Better Best is powered by Chargebee

Stop guessing at AI pricing. Look at what actually works.

Smart companies don't reinvent the wheel, they study how others in their space price AI features, structure tiers, and handle usage billing.

Chargebee's Pricing Repository shows you exactly how companies like Figma, Miro, and ElevenLabs monetize AI. You'll see their pricing tiers, feature packaging, discount strategies, and billing models.

No fluff. Just the strategies that work, ready for you to adapt.

Pricing Retrospective: Canva, Figma, and Adobe

This week, we did some digging into the PricingSaaS index to see how key players in the design category have adjusted their pricing strategy over the past couple years.

Design is an interesting category because it has a large, established incumbent (Adobe), a fierce competitor (Figma), and another big player optimized for beginners and non-designers (Canva).

Importantly, each of these companies is past the scrappy startup phase where they’re singularly focused on acquisition. Over the past couple years, each company has made pricing changes that serve their own specific product stage. Below, we’ll break down each company’s strategy and specific moves.

PS. We analyzed each change and packaged it into a retrospective for easy reference.

[Download the full Retrospective →]

Single Product Expansion (Canva)

Canva has a single core product, and a single user type. This is where most SaaS companies live.

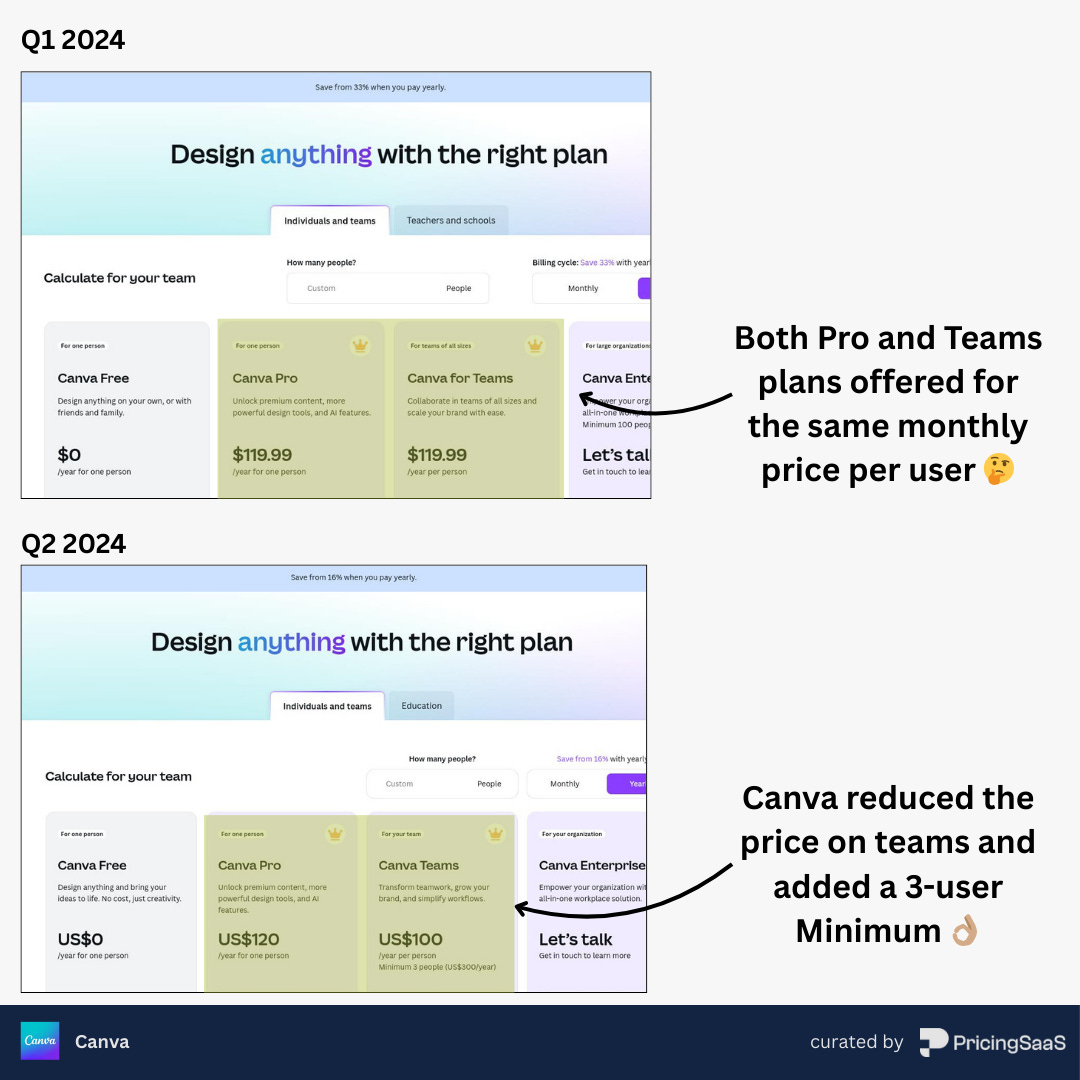

Heading into 2024, Canva had a questionable strategy where the Pro and Team plans were offered for the same price.

Thankfully, they got their act together. First, they made two big changes to the teams plan:

Reduced the price per seat, making it a value compared to Pro.

Introduced a 3-seat minimum to avoid cannibalizing revenue.

This change alone created a natural story to drive prospects with multiple users to the Teams plan. While I’d argue they should charge more for Teams, Canva relies a lot on PLG for core plans and this is a very low-friction approach.

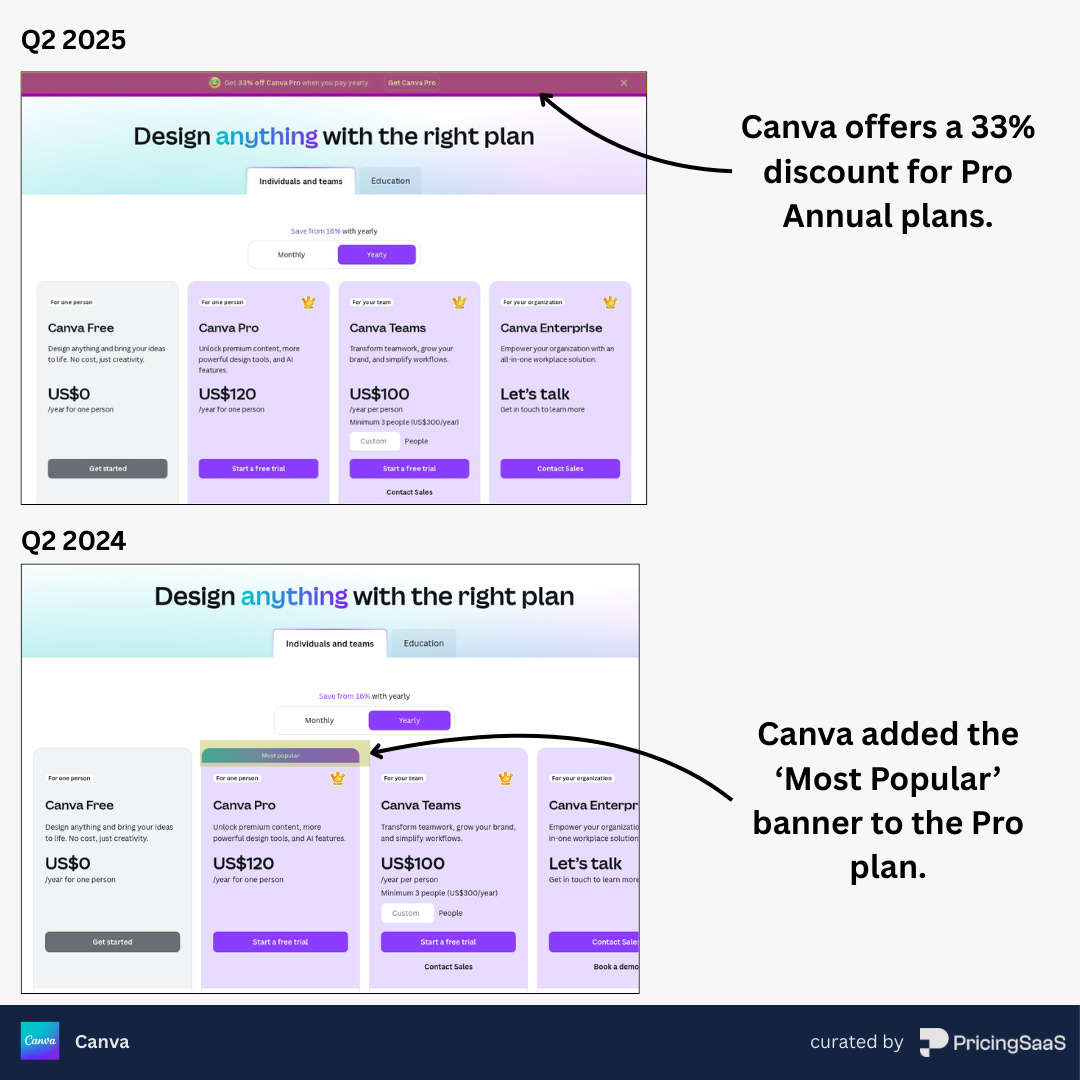

Next, they focused their attention on the Pro plan, using both behavior psychology and discounting tactics.

First, they offered a 33% discount for Pro users to upgrade to annual.

Then, they added a ‘Most Popular’ banner to the Pro plan to drive new prospects to that plan immediately

Key Takeaways

As a single user, single product, Canva’s goals are pretty straightforward. They want to incentivize individuals to be customers for longer to reduce churn, and they want to incentivize teams to add as many users as possible to drive account expansion over time. Over the past couple years, Canva’s moves have been optimized to solve for both.

Platform Expansion (Figma)

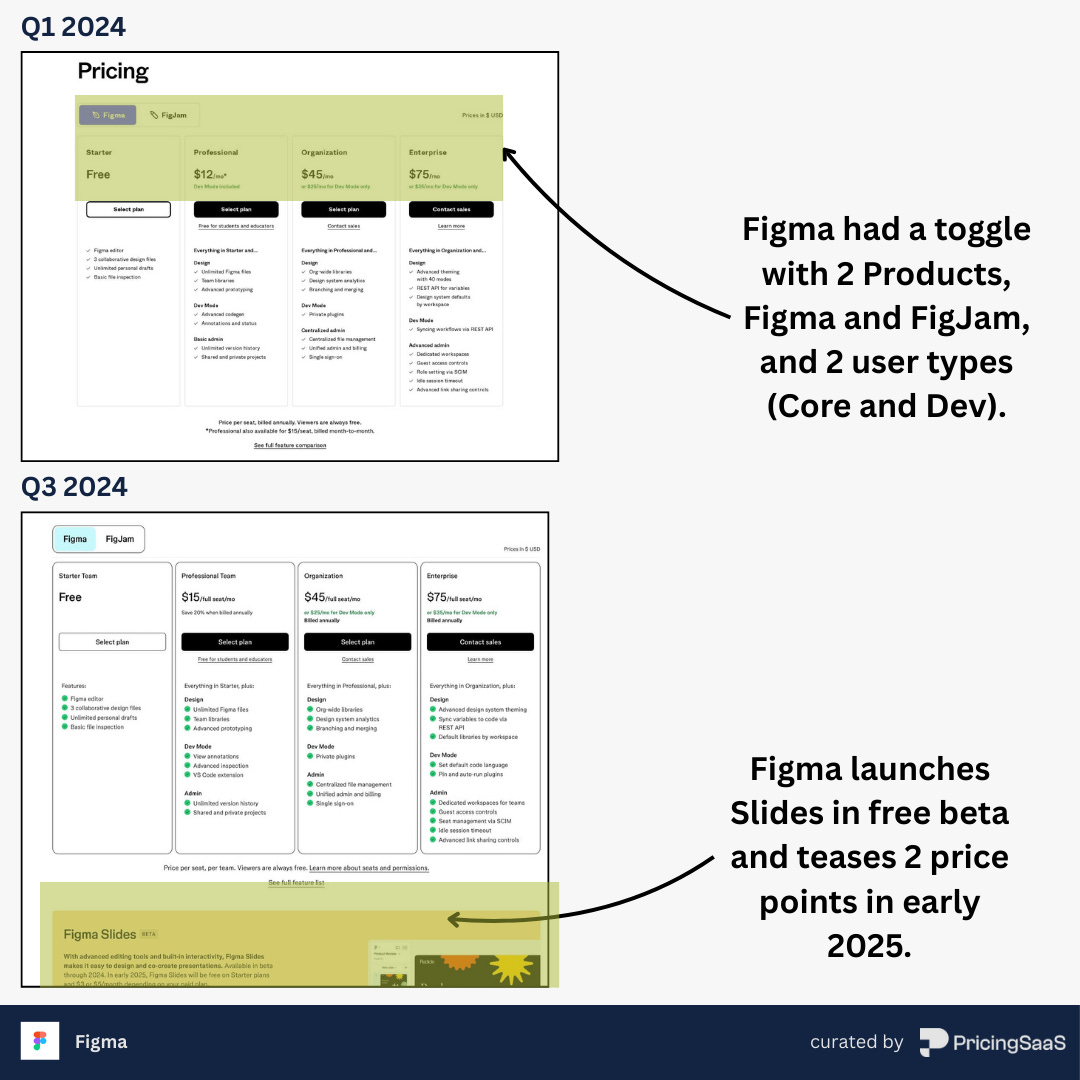

Unlike Canva, Figma has multiple products and user types, and ship new products rapidly. That combination can add up to a lot of complexity fast.

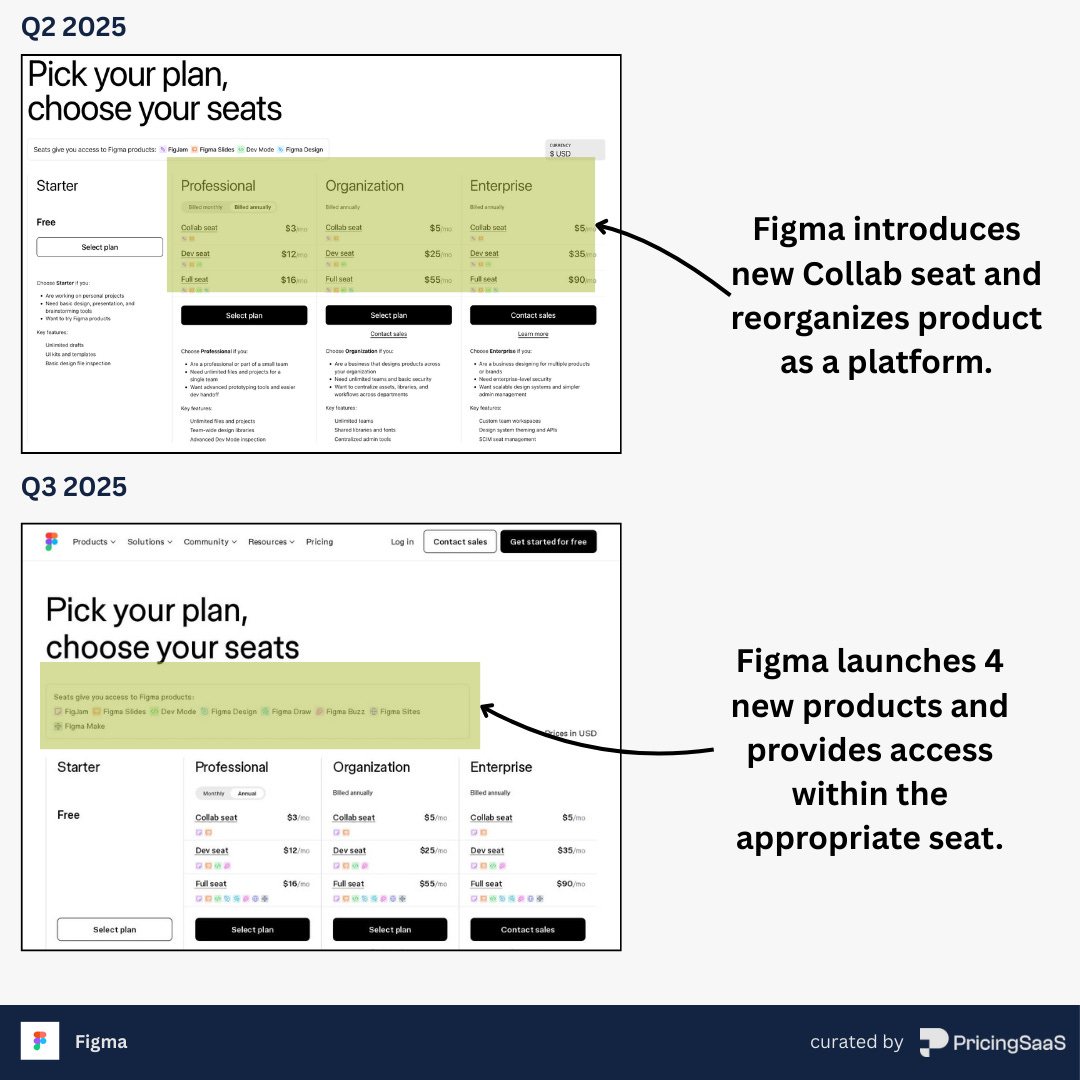

They started 2024 with two user types: Core and Dev, and two products, the core product and FigJam, their digital whiteboarding tool. In mid-2024, they introduced Figma Slides in free beta, and teased $3 and $5 price points to come in early 2025. T

You can see how this could quickly start to spiral if they treated Slides exactly like FigJam. The pricing page would become a mess with multiple tabs, and discrete plans and price points for different products and users.

But in early 2025, Figma found a more elegant solution. They introduced a new Collab seat within the core offering that provided access to FigJam and Figma Slides. This model gave Figma an easy structure to use for future product releases, which they promptly did.

In Q3 2025 they released 4 new products: Figma Buzz, Figma Draw, Figma Make, and Figma Sites. Figma kept Collab seats the same, gave Dev seats access to Buzz and limited the other products to the Core seat.

Key Takeaways

Figma's moves show a company transitioning from multi-product to platform. The typical way to do this is to add new products that have independent subscriptions (e.g., HubSpot).

Instead, Figma introduced new seat types that offer different levels of access. This has 3 immediate benefits:

Reduces complexity when launching new products. They quickly showed how the dynamic works by launching 4 new products and adding value to existing users.

Creates a natural expansion story for customers as users want more functionality within Figma.

Simplifies sales conversations and shortens the sales cycle. Rather than having to toggle between different product pages and pricing models, Figma sellers can show prospects one platform with different user types.

In an era where people are saying “per seat” pricing is dying, Figma’s model is an innovative example of how seats can evolve to serve modern buyers.

Quick note: Ulrik and the WTP team are hosting a webinar next Thursday, September 25th to go deep on tokens, credit systems, and AI pricing models. You won't want to miss it. Register here → Portfolio Retention (Adobe)

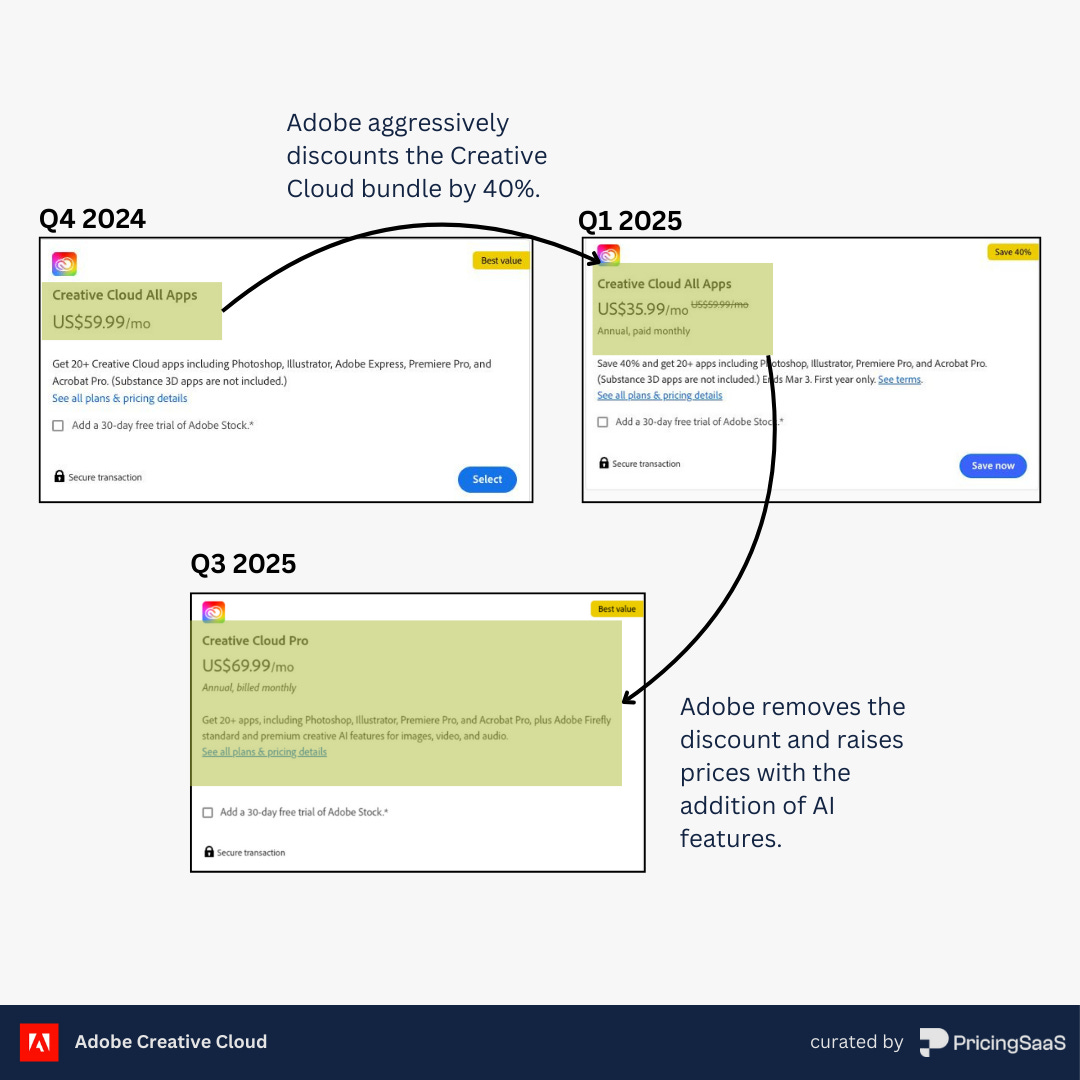

Lastly, there’s Adobe. Unlike Canva and Figma, Adobe is a well-established incumbent who doesn’t just want to expand accounts, but also wants to protect their turf.

With 20+ products, Adobe’s strategy over the past couple years has focused on using bundle economics to drive adoption and expansion.

Adobe entered 2024 offering Creative Cloud for $59.99 per user/mo. In 2025, they dropped that price by 40%. Interestingly, this was a quarter before Figma went public, which feels…spicy 🌶️.

By Q3 2025, they not only removed the discount, but raised the price of Creative Cloud to $69.99 per user/mo on the strength of new features including unlimited image generation, AI credits for video and audio, and the ability to use non-Adobe AI models in Firefly.

Key Takeaways

As the mature player facing competitive pressure (notably around Figma's IPO), Adobe used bundle mechanics strategically. They dropped prices 40% to capture market share, then raised prices $10/month while adding AI features to justify the increase. For companies with robust product portfolios, bundle pricing becomes both an acquisition tool and a defensive moat.

The Deeper Lesson

Whether you're optimizing a single product like Canva, building a platform like Figma, or defending market share like Adobe, the key is aligning your pricing changes with your specific growth stage and competitive position.

Whatever your company's primary goal right now, you can likely take inspiration from the examples above. Check out the full retrospective for a detailed view of each individual pricing change to add to add to your swipe file.

If you could use a sounding board, you know where to find me.

Thanks for reading! When you’re ready, here’s how we can help:

PricingSaaS Community: Join the free PricingSaaS Community to get quick answers from experts, real-time pricing data, and access to exclusive events.

PricingSaaS Index: Check out the PricingSaaS Index to track competitors, scroll pricing histories, and create a swipe file of pricing pages for inspiration.

Free Advisory Session: Need a sounding board? Book a 30-minute session. No sales pitch. We’ll provide honest feedback and steer you in the right direction.

What’s your take on Teams pricing?

A: they buy more seats, so volume pricing, improves growth opportunity (=lower)

B: they get more functionality (=higher)

I love seeing these changes over time. A big service to the SaaS community. Good analysis here too.