Pricing Roundup (featuring Casey Hill)

Changes from Asana, Buffer, Botpress, Pipedrive, and Fivetran.

Every week, we share research and resources to help SaaS leaders make smarter pricing and packaging decisions. Grab our latest research to stay ahead of the curve.

🔌 PricingSaaS Partners power the next era of SaaS pricing

→ DigitalRoute surveyed 600+ CFOs for their State of AI Monetization report.

→ Metronome shared a list of hot topics for monetization leaders in 2025.

→ Nue created a guide to credit burndown pricing.

→ Schematic gathered top pricing thinkers to share their keys to AI pricing.

📌 Save the Date: Thursday, November 27th at 9am EST

Ulrik Lehrskov-Schmidt and the team at Willingness to Pay are hosting a webinar next Thursday on SaaS pricing for services companies. Register here →

This week we’ve got a guest appearance from my good friend, Casey Hill.

Casey runs marketing at DoWhatWorks, a platform that tracks tens of thousands of website experiments to see what does and doesn’t work. Today, we’re breaking down 5 recent pricing changes together (plus 10 quick-hitters from yours truly).

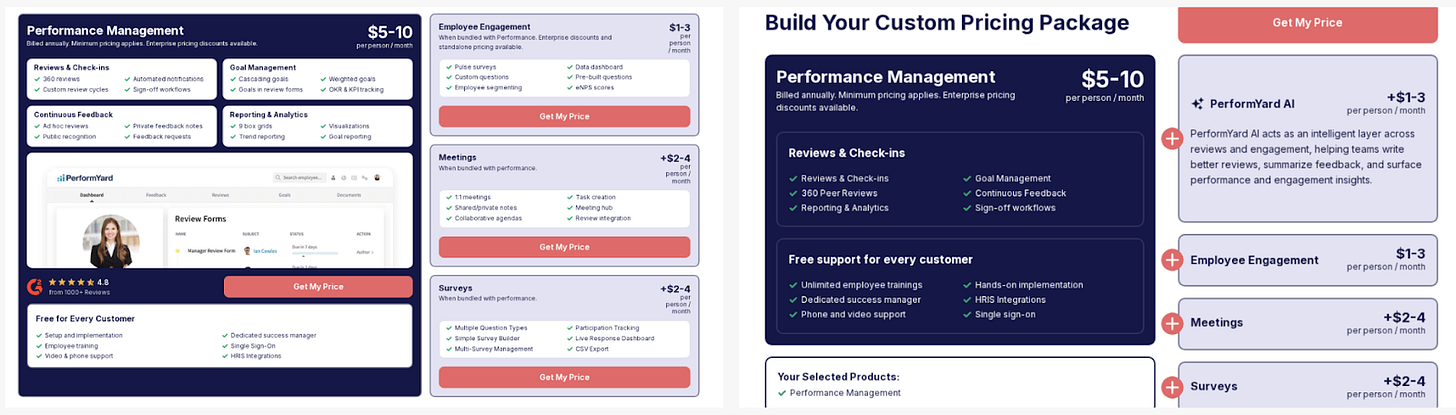

1️⃣ PerformYard simplifies its pricing page layout.

PerformYard drastically simplified their pricing page layout, making a few really sharp decisions to improve clarity:

Consolidated information to improve readability.

Collapsed sections for a cleaner default screen.

Removed excessive CTAs.

The result is a page that’s much easier to read and navigate. Here’s Casey’s take:

Clearly much better visually, and they get rid of the G2 social proof on the pricing page, which we see perform poorly (examples here).

2️⃣ Pipedrive adds granular usage thresholds across all plans.

Pipedrive added usage thresholds for several variables, including:

Leads and Deals (per company)

Custom Fields (per company)

Reports (per seat)

Automations (per company)

The updates give Pipedrive more levers to drive upgrades, but somewhat at the expense of their “easy CRM” positioning.

Casey’s unsurprised, and felt it was inevitable:

This is very common in the ESP/CRM space, where I have spent most of my career. The idea of better pairing cost to usage is a major focus of these companies, and makes a ton of sense for Pipedrive.

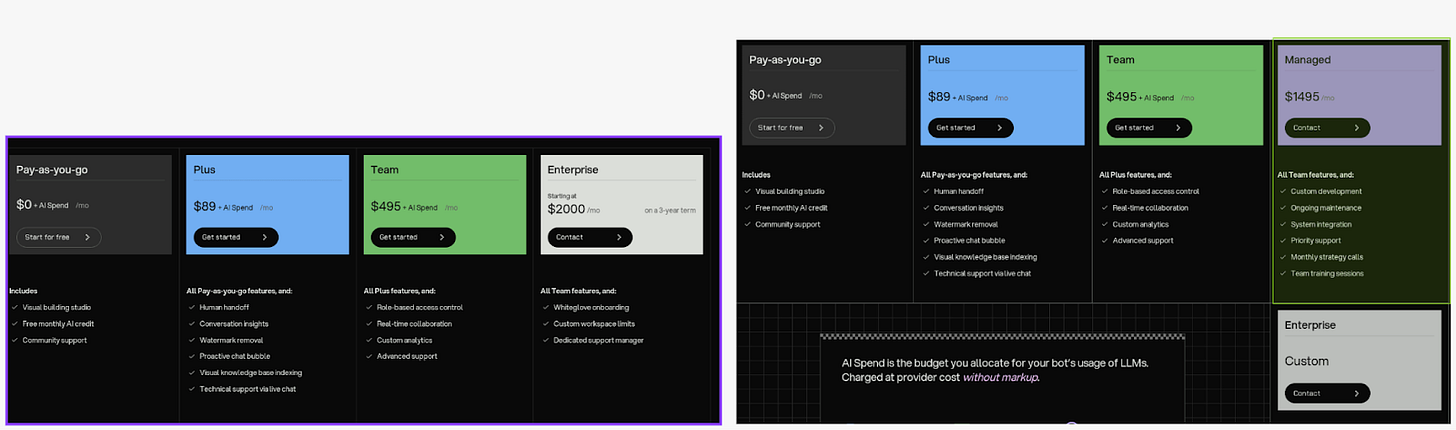

3️⃣ Botpress launched a Managed tier between Team and Enterprise.

Botpress launched an intermediate plan between Team and Enterprise called Managed which includes custom development, ongoing maintenance, priority support and training, and monthly strategy calls. Managed is 3x the price of Team, nearly as expensive as the old starting price for Enterprise. Speaking of, Botpress removed public pricing for the Enterprise plan, updating it to Custom.

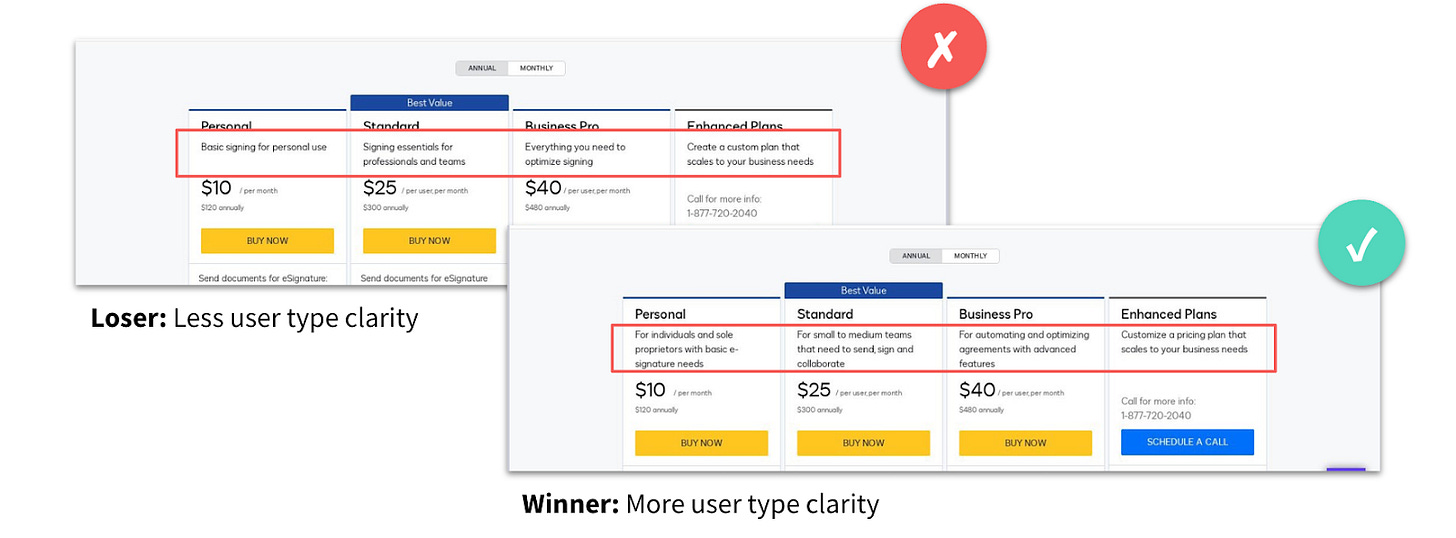

This seems like a clear move to differentiate between two value drivers: custom usage and premium support for higher ACV customers. Casey believes (and I agree) they could do a better job of showing who each plan is for:

This brand would really benefit from persona sub-headers to better align prospects to the right plan. We see this win at DoWhatWorks in the majority of tests. This is one from Docusign.

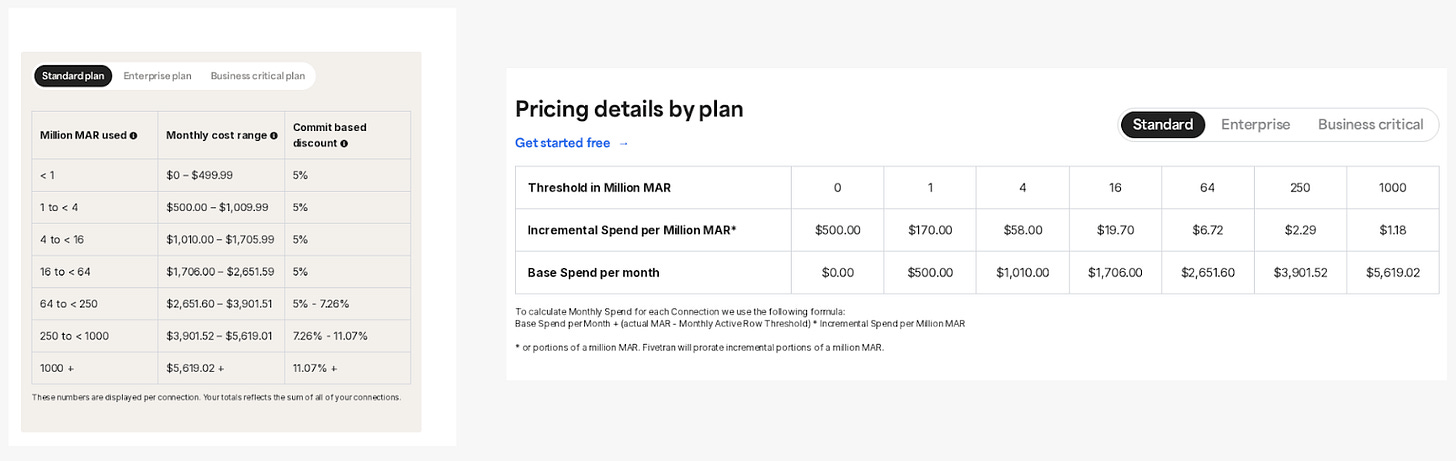

4️⃣ Fivetran reframed pricing details.

Specifically, they shifted to from a range with a commit-based discount to base + incremental. Not only is this more readable, but it removes the word discount from the page, and more clearly shows visitors how price is calculated. They also have a great Pricing Calculator on the page to support this. Casey has found moves like this tend to work well:

This aligns with the idea of clear, simplified pricing, which we’ve seen outperform regularly. When we say outperform, we’re looking at A/B tests and watching which version the company ends up going with. We tend to see companies stick with the version that indexes for clarity.

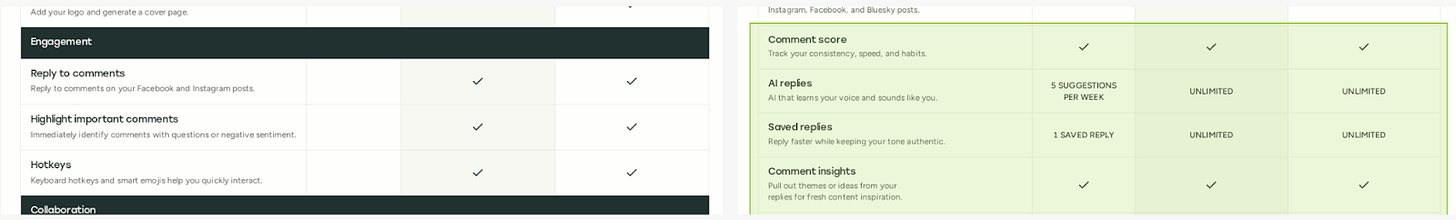

5️⃣ Buffer rebrands Engagement as Community and adds features.

Buffer rebranded “Engagement” features as Community, and added new functionality, including Comment Score, AI Replies, Saved Replies, Comment Insights, and the ability to Turn Comments into a Post. Casey is one of the best LinkedIn follows in SaaS, so I wanted to get his take on this from both a pricing and product perspective. His take:

I’m curious the quality of the AI answers. I’ve never seen good ones on LinkedIn (or maybe they are so good I don’t realize they are AI comments). But more generally, I think making the category association with community is a smart play.

Follow Casey on LinkedIn and check out the DoWhatWorks newsletter to follow the latest experiments he’s tracking.

Read on for 10 more quick-hitter pricing changes from the past week 👇

Asana cut the Personal plan user limit from 10 to 2 →

This feels like classic free to paid conversion and makes a lot of sense, but 10 to 2 is an aggressive pullback. Notably, Monday.com limits the free plan to 2 users while ClickUp doesn’t have a user limit at all.

Freshworks removed its AI bundle and raised the price of its AI Agent →

Both moves seem geared towards monetizing AI more directly, which makes me think two things:

They were giving up too much margin in the previous model.

People actually use their AI, which is why they were giving up margin.

Dropbox renamed plans and drastically reduced usage limits →

Dropbox renamed plans and cut Standard storage from 9TB to 5TB, reduced signature requests from unlimited to 3/month, and slashed file uploads from 10 to 4.

Intercom introduced Fin Voice with custom pricing →

Intercom added Fin Voice, a new voice-based AI capability, to their product lineup. The feature is offered through custom pricing plans and appears in their FAQ section.

Pricing remained the same.

Loom expanded its video editing suite →

The update includes 4 new features: Backgrounds, Live Rewind, Stylized Captions, and text/box/arrow overlays. They also introduced a 99.95% uptime SLA for Enterprise plans, and added video download restriction controls for admins.

Docusign adjusted Enterprise plans for the Developer API product →

The plan is now called ‘Enhanced Plans’ and requires a 5-user minimum. Usually, not a fan of user minimums, but on an Enterprise/Enhanced plan, it’s more forgiveable.

Chargeflow is offering $10,000 in free chargeback automation for Black Friday →

Black Friday discounts are popping up everywhere, but the $10,000 number is eye catching (and also lets people experience their outcome-based pricing).

Jam removed unlimited Creator seats in Enterprise →

Small, but significant move. Seems like they want another lever for Enterprise expansion, and this unlocks more upside.

Appian moved from Tokens to Actions based pricing →

Gotta read the fine print on this one, but it seems like this is setting up for outcome based pricing down the road.

Explore more changes from Gusto, Databricks, and Pinecone at PricingSaaS →

Thanks for reading! When you’re ready, here’s how we can help:

PricingSaaS Community: Join the free PricingSaaS Community where 800+ SaaS operators get answers from experts and access to exclusive events.

PricingSaaS Index: Check out the PricingSaaS Index to track competitors, scroll pricing histories, and create a swipe file of pricing pages for inspiration.

Free Advisory Session: Need a sounding board? Book a 30-minute session. No sales pitch. We’ll provide honest feedback on your pricing strategy and tech stack.

would love your thoughts on some of my stuff. follow me back, I could DM you?