The Playbook Behind Fullstory’s Enterprise Transformation

Plus: 3 tips to successfully move upmarket.

Welcome back to Good Better Best!

This week we’re going deep on upmarket expansion. A couple weeks back, I caught up with Justin Traister. Justin leads data insights at Fullstory, and gave me the scoop on their transformation from serving SMBs to enterprise buyers.

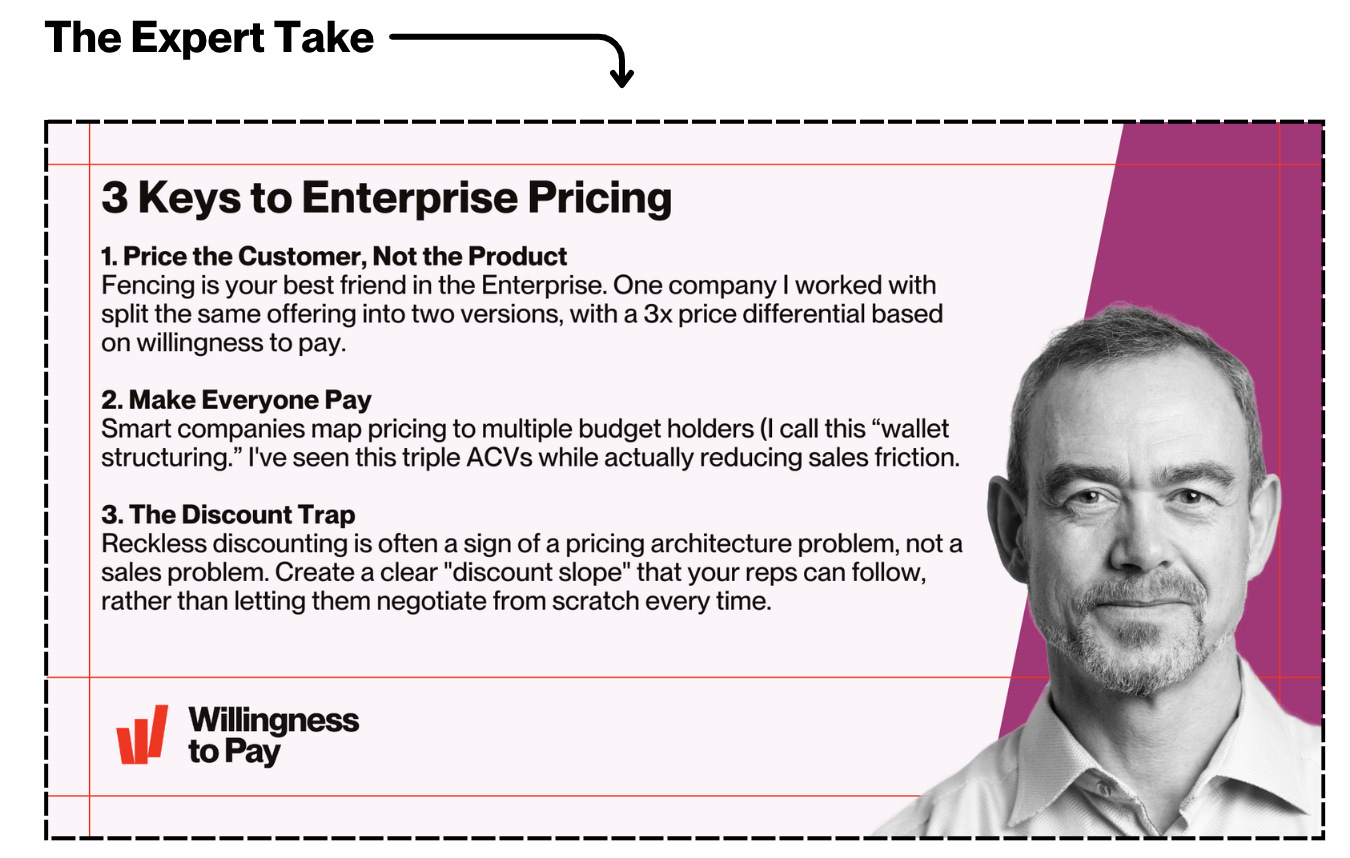

There’s a lot to unpack, and tons of useful takeaways for other SaaS builders looking to make a similar move. Don’t miss this week’s expert take, where Ulrik shared some of his top tactics for selling to enterprise buyers.

Let’s get to it.

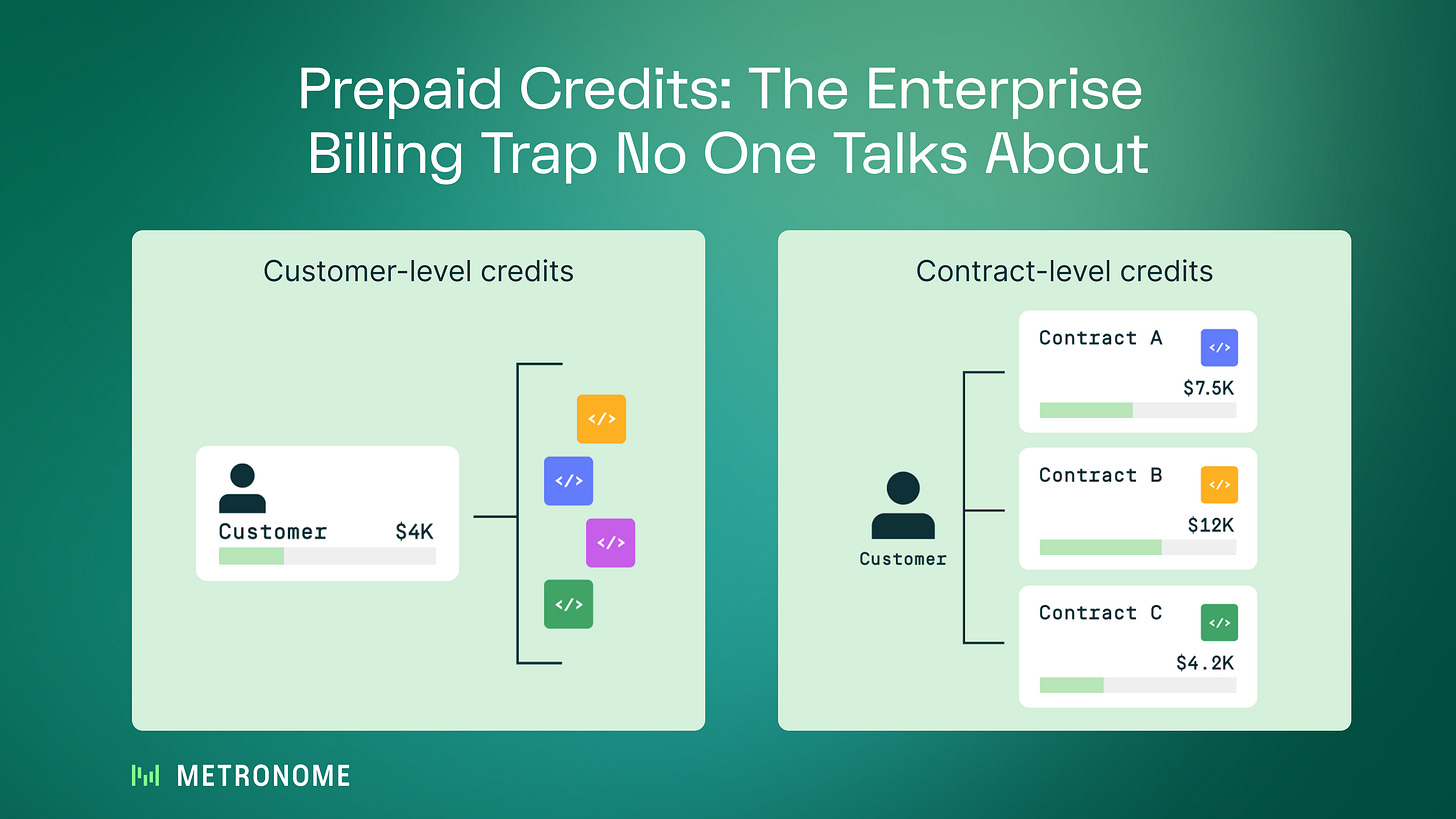

Prepaid credits are quietly killing your enterprise deals

The wallet model works—until it doesn’t. As prepaid credits go mainstream in usage-based pricing, most teams miss a critical detail: the difference between customer-level and contract-level credits.

This post breaks down how that small architecture decision can snowball into audit flags, margin erosion, and customer churn as you scale. If you’re selling to enterprise, read this before your next RFP.

Fullstory’s Enterprise Playbook, explained

When Fullstory's first data insights lead Justin Traister joined the pricing team in 2022, he walked into a company at an inflection point.

Initially a session replay tool for small businesses, Fullstory underwent a dramatic transformation into an enterprise-ready platform. Their journey provides a playbook for SaaS companies aiming to move upmarket without losing their core identity.

The Starting Point: Built for Simplicity

Fullstory's origins were rooted in serving VSBs (very small businesses) and SMBs with a straightforward approach. The company offered simple month-to-month billing and what Justin calls their "legacy pro" plan as the core offering. This model worked well for their initial market, but by 2019, leadership recognized they needed to expand their addressable market.

The challenge many SaaS companies face when moving upmarket is that enterprise buyers have fundamentally different needs, buying behaviors, and expectations. Here’s Justin on the initial thinking:

Fullstory very much has its roots in a VSB/SMB operation but our aim was always to move upmarket. 2019 kicked off that effort in earnest. At that time it was much more of a focus on commercial segments. For instance, let's move away from month-to-month billing and customers who churn faster, let’s build out a sales-led cycle, and let’s continue to roll out enterprise functionality to see if we can attract a different, upmarket buyer.

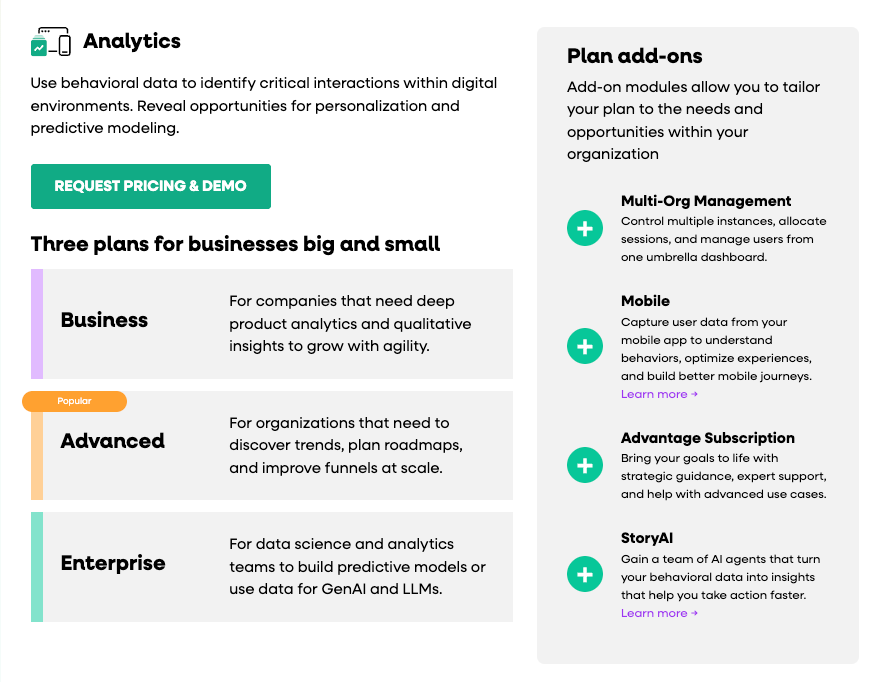

The first step in Fullstory's upmarket journey involved restructuring their product offerings to serve different customer segments effectively. Justin’s first project was creating an "Advanced" plan that could bridge the gap between their existing Business and Enterprise tiers.

This evolution created a classic Good-Better-Best structure:

Business: Entry-level paid tier focused on session replay and core analytics

Advanced: Mid-market focused offering that adds advanced analytics

Enterprise: Full feature access including SSO and multi-org support

This was a solid start, but pricing was just the tip of the iceberg. Fullstory's transformation required rethinking the entire product architecture, service delivery, and go-to-market strategy.

The Three-Pillar Transformation

Pillar 1: Product Architecture for Enterprise Complexity

The real transformation started in 2023, when Fullstory started evolving from a single product into a multi-product platform.

In addition to Fullstory Analytics, which served product, engineering, UX, and data teams, they introduced three new offerings over the past couple years:

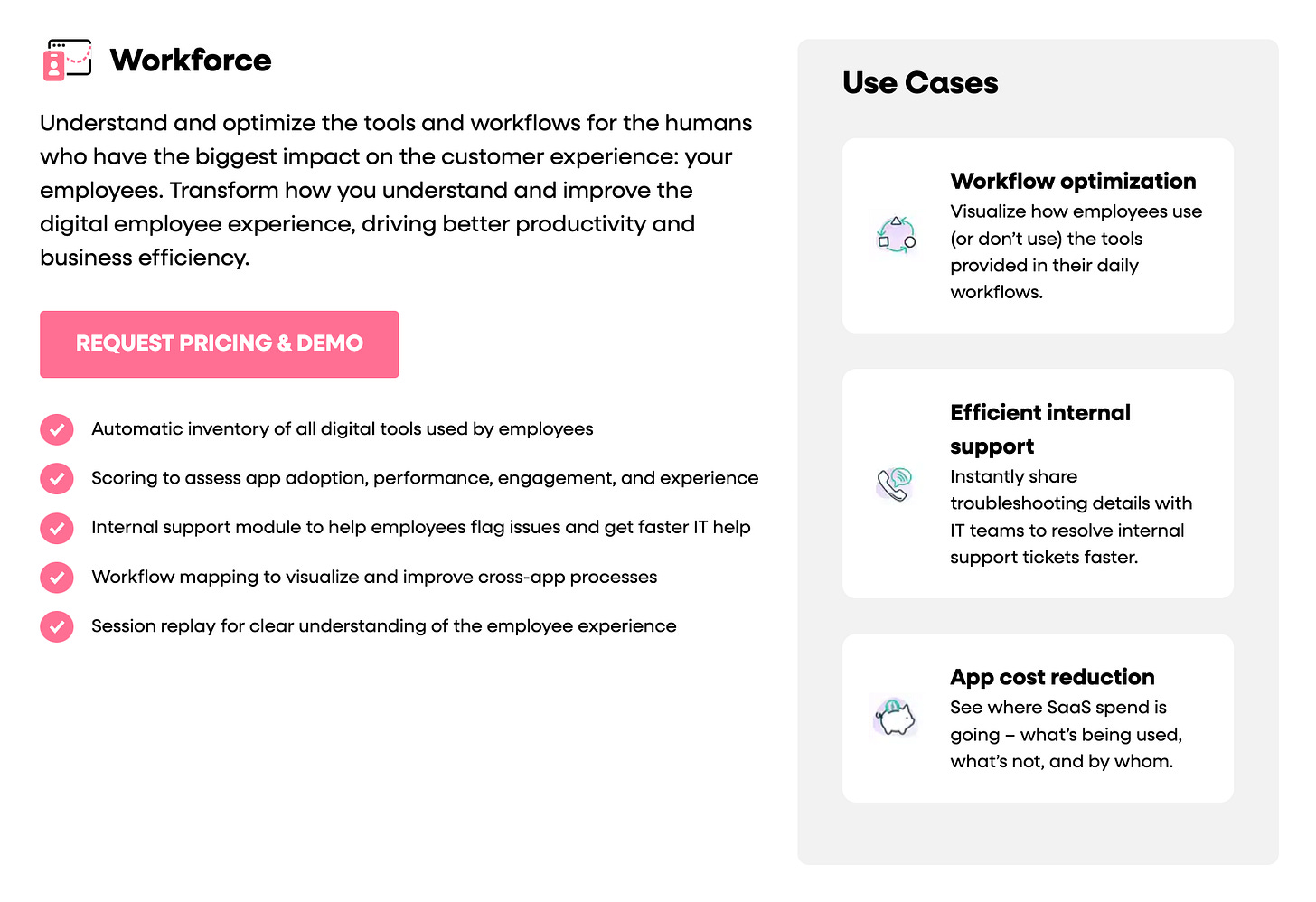

Workforce represents perhaps the most interesting strategic bet. This IT-centric tool monitors SaaS app usage and helps reduce spending by providing visibility into how enterprise applications are actually being used.

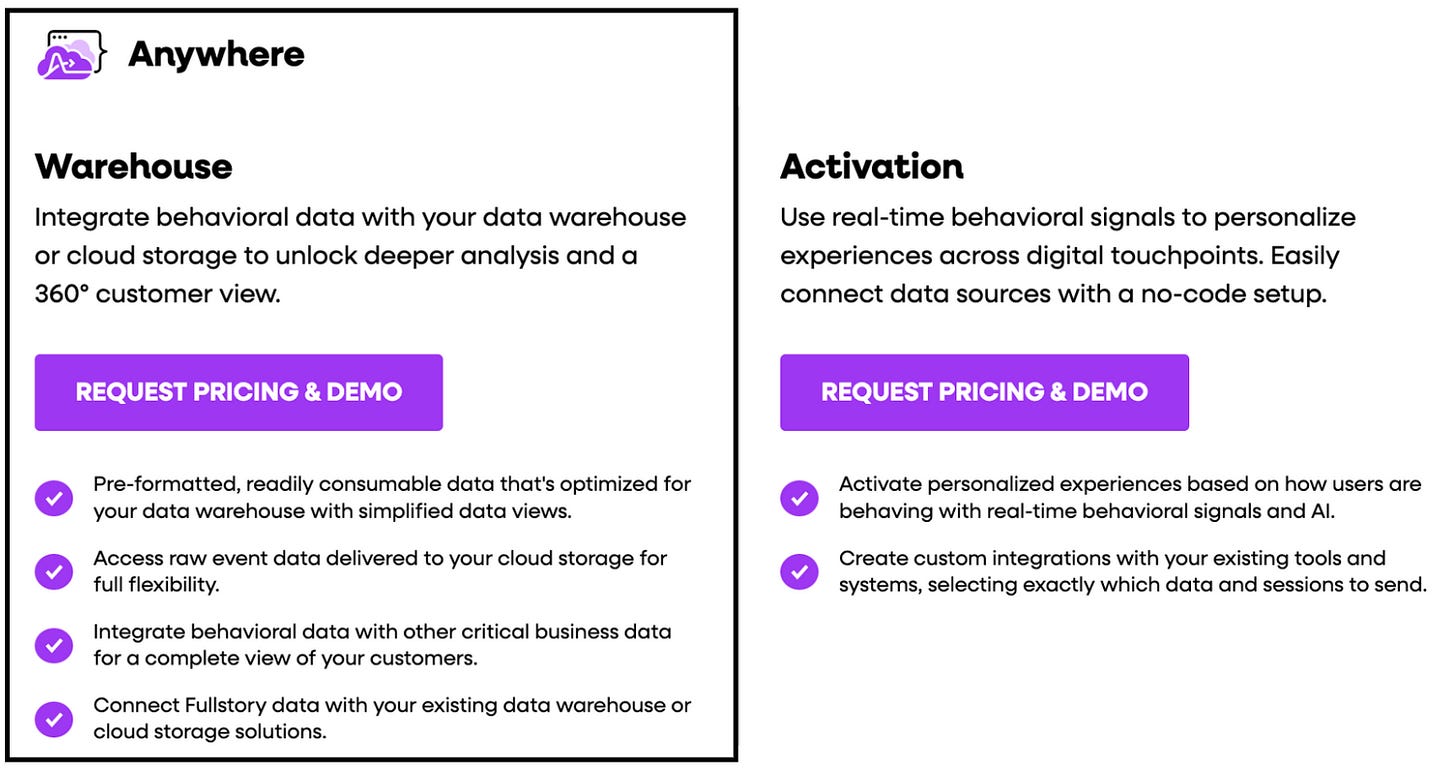

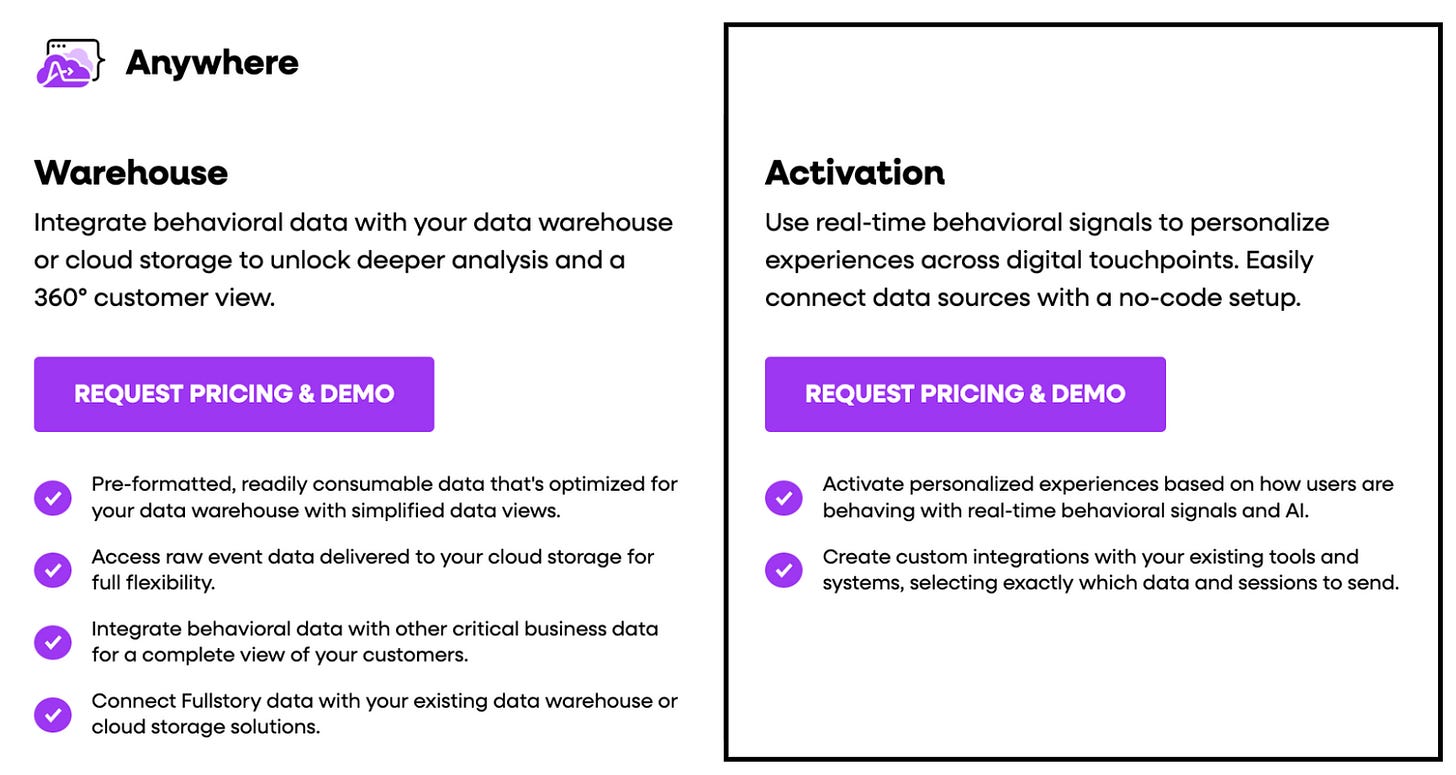

Anywhere: Warehouse addresses the enterprise need for data integration by enabling customers to export raw event data to warehouses like Snowflake and BigQuery. This unlocks possibilities for BI teams to join Fullstory data with other systems like Salesforce and Zendesk, enabling sophisticated analysis like churn modeling and propensity scoring.

Anywhere: Activation focuses on real-time behavioral intelligence, offering personalized experiences. This represents Fullstory's evolution from an analytics tool into an action engine.

Each of these products addresses pain points for Enterprise buyers. And according to Justin, there’s a good chance the product balance shifts in the future.

It's my pet hypothesis that Workforce could end up being a true leader among our product portfolio. The buyer is different, and it's much more IT focused, which opens up huge market opportunity and TAM beyond our classic personas: product, engineering, UX-design, and data teams.

Beyond Product, Fullstory also realized they needed to make a push on the services end to appeal to a new customer profile.

Pillar 2: Professional Services as a Value Driver

One of the most significant changes in Fullstory's enterprise journey was recognizing that their product's power and depth came with opportunities for onboarding and professional services to multiply customer value. As Justin candidly put it:

Fullstory is an incredibly powerful product. Since we made onboarding mandatory, the customers that go through Fullstory-led onboarding showing incredibly high GDR and NDR. It makes a huge difference that helps maximize customer value and drive excellent outcomes.

This created the following onboarding mix:

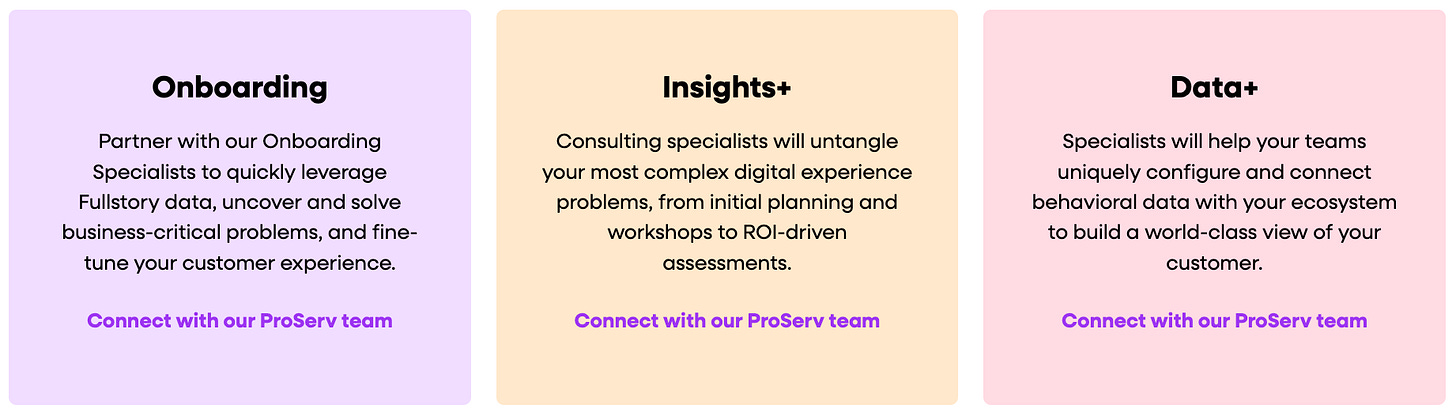

Self-Led Education available via Fullstory | Learn.

Onboarding available in different tiers to address diverse customer requirements.

Custom insights services for high-touch enterprise needs providing in-depth guidance and maximized impact.

Alongside onboarding, Fullstory also offers specific professional services around Insights and Data, and the "Advantage" subscription for Fullstory Analytics, which bundles white-glove support, guided dashboards, and custom analytics to ensure customers achieve ROI.

Intuitively, customers who are more thorough about setting up data management, privacy capture rules, and integration settings demonstrated better outcomes and lower churn rates.

Pillar 3: Go-to-Market Strategy for Enterprise Sales

Beyond Product and Services, Fullstory evolved their GTM to better align with Enterprise buyers as well. This involved several key changes that reflect how enterprise buying differs from SMB purchasing:

Focused ICPs: Fullstory got hyper-specific about target customers with an effort called “Bullseye” where they honed in on industry, geo, company size, and buyer.

Sales-Led Free Trials: While they maintained a free trial option, it primarily became a tool for proof-of-concept engagements with enterprise buyers, guided by sales representatives rather than self-service adoption.

Multi-Year Deal Structures: The shift to multi-year agreements helped increase average selling prices while reducing churn, though it came with the trade-off of longer deal cycles.

Price Floors and Market Focus: Fullstory instituted minimum price thresholds to filter out VSB and SMB customers who typically showed higher churn rates. This was coupled with a "relentless focus upmarket" driven by a new Ideal Customer Profile exercise to identify specific buyers, teams, industries, and geographies to target.

The Role of Data in Transformation

Throughout this journey, Fullstory's approach was notably data-driven. They tracked cost-per-session as a critical engineering metric to remain competitive on pricing. They used win-loss analysis to understand that pricing and ROI were the top reasons for lost deals, which informed their cost optimization efforts.

The company also developed sophisticated internal analytics, using their own Anywhere: Warehouse and Activation product in Looker joined with Salesforce and Zendesk data to create churn models and propensity scoring. This self-usage of their platform provided both internal insights and powerful customer proof points.

Challenges and Trade-offs

Fullstory's transformation wasn't without challenges. Moving upmarket meant accepting longer deal cycles in exchange for larger deal sizes.

The company continues to support legacy plans for existing customers who renew, but new customer acquisition is focused almost exclusively on commercial, and enterprise segments. This approach requires discipline—saying no to revenue that doesn't align with strategic direction.

Key Takeaways for SaaS Operators

Fullstory's journey offers several insights for SaaS builders considering an upmarket move:

Product transformation must address enterprise buyer needs, not just scale existing features. Case in point: Fullstory's most significant growth opportunity (Workforce) serves an entirely different buyer persona than their original product.

Professional services amplify customer value and drive faster outcomes. Professional services are a leverage multiplier, ensuring customers maximize the product's potential and achieve their unique goals effectively.

Pricing strategy must evolve to match enterprise buying behaviors. This often means moving from transparent, self-service pricing to consultative, customized deal structures.

Data-driven decision making is essential throughout the transformation. Fullstory used extensive analytics to guide product development, pricing optimization, and customer success metrics.

Organizational focus and discipline are required to resist the temptation of smaller deals. Setting price floors and ideal customer profiles helps maintain strategic direction even when individual opportunities seem attractive.

The most compelling aspect of Fullstory's story is how they maintained their product-led growth DNA while building enterprise capabilities. Rather than abandoning their roots, they found ways to serve both markets appropriately—supporting existing customers while focusing new acquisition efforts in target segments.

Thanks for reading 🙏🏼

Good Better Best is hand-crafted and always free. If you’ve gotten value from it, share it with someone who might enjoy it too.

PS. If you could use a sounding board on your own pricing strategy, book time with me.