The Pricing Ratio: A Trick to Estimate Churn in 10 Seconds

Plus: The inside scoop on Zapier's platform shift.

Every week, we provide research and resources to help SaaS leaders make smarter pricing and packaging decisions. Get our latest research to stay ahead of the curve.

🔌 Good Better Best is powered by Lago

Multi-product, multi-entity, multi-geography, multi-everything. As you scale, billing gets more complex until homegrown systems crumble and you need to hire engineers just to keep using legacy vendors.

Lago is the open-source billing system that supports all common pricing models (including AI pricing like credits, usage, and outcome-based pricing) without turning billing into a nightmare.

Don’t tie yourself to a vendor. Lago lets you inspect the codebase, self-host on your own premises (or VPS) and customize anything you want.

Want to find out more about designing usage-based pricing models?

Notion added AI agents and granular database permissions.

Airtable introduced AI credit packs.

Chili Piper introduced a Chat AI product for $20k per year.

Klaviyo introduced 3 AI-powered customer service tools.

Softr introduced a Database Agent feature.

Explore more recent changes from Linear, Twilio, and Canva at PricingSaaS →

Last month, Zapier introduced a major pricing change, shifting from a multi-product model toward an integrated platform designed for AI orchestration.

I caught up with Giang Hoang, Head of Business Operations at Zapier, to learn how it all went down. The conversation is full of gold that other SaaS leaders can pull from as they navigate similar challenges, including:

How to treat pricing as a living system that evolves with product

How to roll out a meaningful change to customers

How to evolve on existing value metrics to move towards credits and outcomes

Below, I’ve shared some of the highlights.

On aligning pricing and packaging with wider positioning:

Zapier is the most connected automation and AI orchestration platform - connecting apps, data and AI through one integrated experience. Our pricing and packaging needed to reflect our product evolution.

Previously, we had our core product, Zaps, and separate add-ons. That made it seem like the workflow product was the core, and the rest were optional. But our intention was always to deliver an integrated experience.

We wanted one plan, one platform, where customers get our platform upfront, no friction, no decision paralysis. Just sign up and start building complete systems. That’s what this change accomplishes.

On making the update customer-friendly:

We unified four products: Workflows, Tables, Interfaces, and MCP into a single Zapier plan, increasing value without changing base prices for most customers. Existing customers just get more value. If they paid for these products as add-ons, we credited them.

We also removed arbitrary usage limits. Instead of capping tables or projects, we now offer unlimited tables and projects but apply generous account-level caps on Table records and Interface pages.

Lastly, we mapped all customer histories to ensure everyone was routed to an equal or better plan.

What was the process like for making this change?

We start with closed betas as new products mature, testing products in isolation with small customer sets. Then we move to open betas, then GA (general availability). After that, we might bundle, like we did last year.

We bundled Tables, Interfaces, and Zaps and offered discounts to see how users responded. What we learned is that customers used all three together. That validated the idea of bundling and led us to fully unify these products into one plan.

Read the full conversation at PricingSaaS →

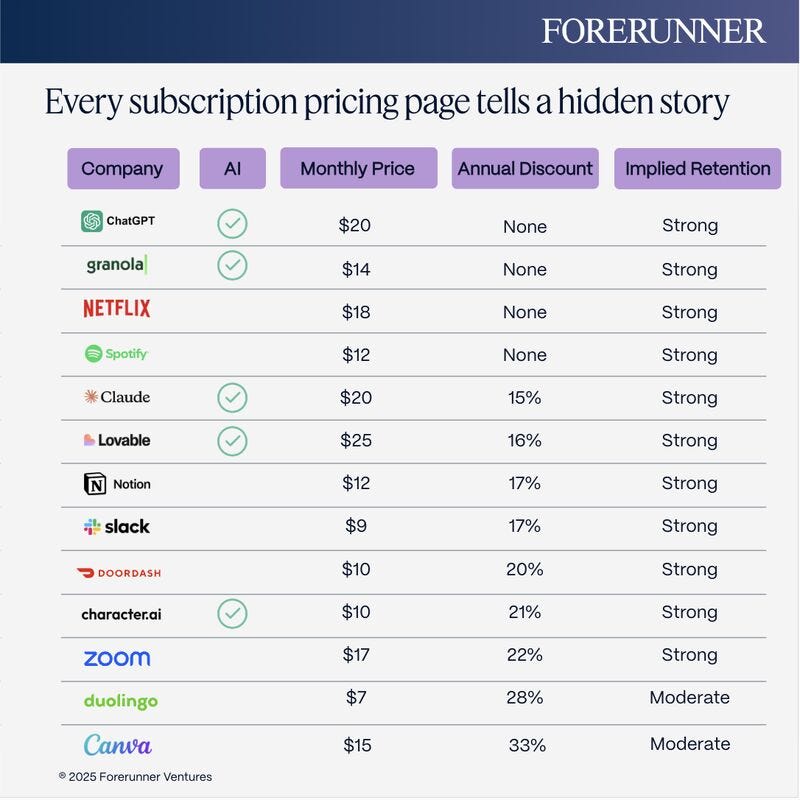

Last week, I shared a framework on LinkedIn from my friend Dan Layfield. Dan is a true expert on subscription businesses.

He led Growth at Codecademy in the heyday, helping take them from $10M to $55M ARR. He also worked on product at Uber Eats, and is the Founder of Subscription Index, where he helps subscription businesses make more money.

The framework is called the Pricing Ratio, and it can help you estimate a competitor’s churn in 10 seconds.

Here’s how it works:

The Pricing Ratio = Annual price ÷ Monthly price

It shows how many months a company is ‘selling’ a year for.

Dan’s insight is that most subscription companies eventually learn to price the annual option just above what the average monthly user pays before they churn to pull cash forward, lock-in users, and lift LTV.

Take Codecademy. Like many ed-tech start ups, they struggled to keep users retained for more than 4-5 months as consumers typically don’t want to learn forever. They want to learn for a few months, then go apply it, then come back.

Dan and his team tested a pricing package where the annual plan was the equivalent of 6 months of monthly payment and saw a huge win. AOV went up, churn went down, payment processing is easier, and they collected more cash up front.

Quick Guide on ratio benchmarks:

3-5: Heavy discount: Users stay 2-4 months (short lifecycle products)

6-8: Moderate retention: Users stay 5-7 months

9-11: Strong retention: Users stay 8-10 months

12+: Very strong retention (long lifecycle) or avoiding prepay risk

If you just read this and immediately wondered, what about B2B SaaS where annual contracts are the norm? You’re 100% right.

The vast majority of B2B products have (or are designed to have) retention of more than 12 months. Mostly because the underlying use case that they solve for is more of a never ending problem. In contrast, the majority of consumer apps have sub 12 month use cases (Dating, fitness, learning, etc).

Real Life Examples

Last week I was looking at Hemingway Editor. They charge $25/mo for monthly and $100/year for a ratio of 4. This suggests most users churn after ~3 months.

Turns out, I wasn’t interested enough to pull the trigger, but the offer was tempting.

After reading the post, the folks at Forefunner Ventures were kind enough to create a visual with a bunch more examples, including many of the top players in AI:

Honestly, the math here checks out. I can’t see a world where I churn from ChatGPT any time soon, and even though I’m a power user, could definitely see Canva subscribers being more fickle.

Even further down this list would be consumer apps like Noom (weightloss), Tinder (dating), and Headspace (meditation), where retention is far more volatile. Do yourself a favor and check out Dan’s full post on the topic to see more examples.

TLDR, the pricing ratio is one of the simplest frameworks in the game, and can help you understand your competitors’ retention or determine where to price your own annual subscription. Use it wisely.

Thanks for reading! When you’re ready, here’s how we can help:

PricingSaaS Community: Join the free PricingSaaS Community to get quick answers from experts, real-time pricing data, and access to exclusive events.

PricingSaaS Index: Check out the PricingSaaS Index to track competitors, scroll pricing histories, and create a swipe file of pricing pages for inspiration.

Free Advisory Session: Need a sounding board? Book a 30-minute session. No sales pitch. We’ll provide honest feedback and steer you in the right direction.

Love the ratio! Also, on a high level - love how the Zapier’s choice is sort of combining both unified billing and a usage based pricing tier