This Week: OpenAI, Figma, Calendly

Plus: Updates from Veed, Hotjar, Zoom, and more.

Every week, we share research and resources to help SaaS leaders make smarter pricing and packaging decisions. Grab our latest resource to stay ahead of the curve.

🔌 PricingSaaS Partners power the next era of SaaS pricing

Need a sounding board? We’ve helped hundreds of teams figure out their pricing strategy and stack. Book a free review →

Howdy pricing people, and happy Friday!

In case you missed it, we published a collection of 100 Add Ons across SaaS product, services, and AI. We’re also testing an assistant that lets you search the collection for specific examples. Browse the collection here →

Good Better Best will be off next week, and will be back strong in 2026. Thank you all for the support this year. Wishing you a relaxing holiday season with plenty of time to reflect and recharge.

On to the week’s biggest news in SaaS product and pricing.

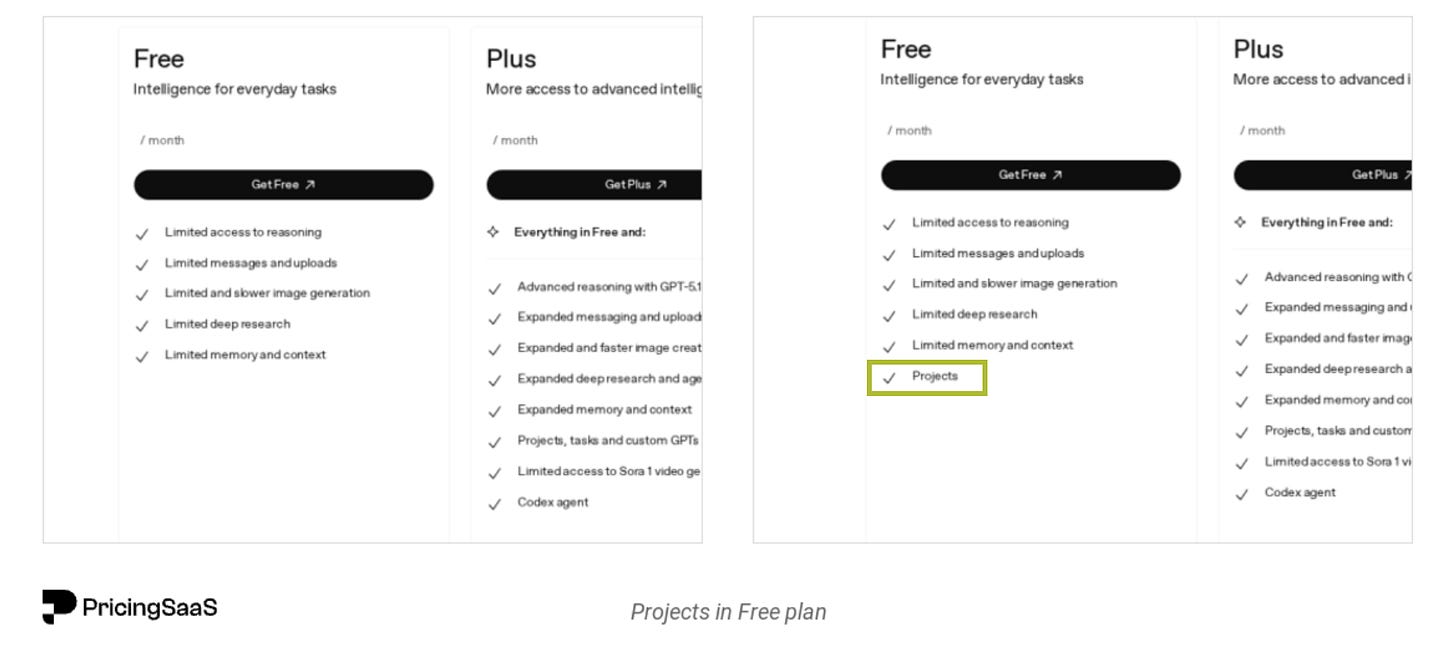

ChatGPT Pushed Projects into the Free Tier

For the past couple years, we’ve seen SaaS companies generally tighten their freemium plans. Less features, lower limits, and more carrots to drive upgrades.

OpenAI just went the other direction. Projects, previously a paid feature is now available to all 800 million ChatGPT users.

This is a classic move to push a value driver downstream, and it should have an impact on user retention, and eventually, monetization.

Projects enables users to store all chats about a particular topic in one place. Its naturally habit-forming, and gets users to engage with the product in deeper, more sophisticated ways. In Projects, users can add instructions, pushing them to use the product more thoughtfully. It’s not hard to see a user getting enough value out of Projects to go even further with Custom GPTs, and upgrading to do so.

Even if users don’t upgrade, there’s a stickiness play. Once someone sets up a project with custom instructions and uploaded context, they’ve created something they’ll return to again, creating switching costs.

Beyond that, OpenAI increasingly dictates what “table-stakes” AI product usage looks like. When they make Projects free, they’re resetting expectations for the rest of the market.

This goes back to something Scott Woody mentioned in our Office Hours event last week. We might be living in the most customer-friendly era of software, ever. OpenAI realizes this and is betting on generosity in hopes it will pay off later.

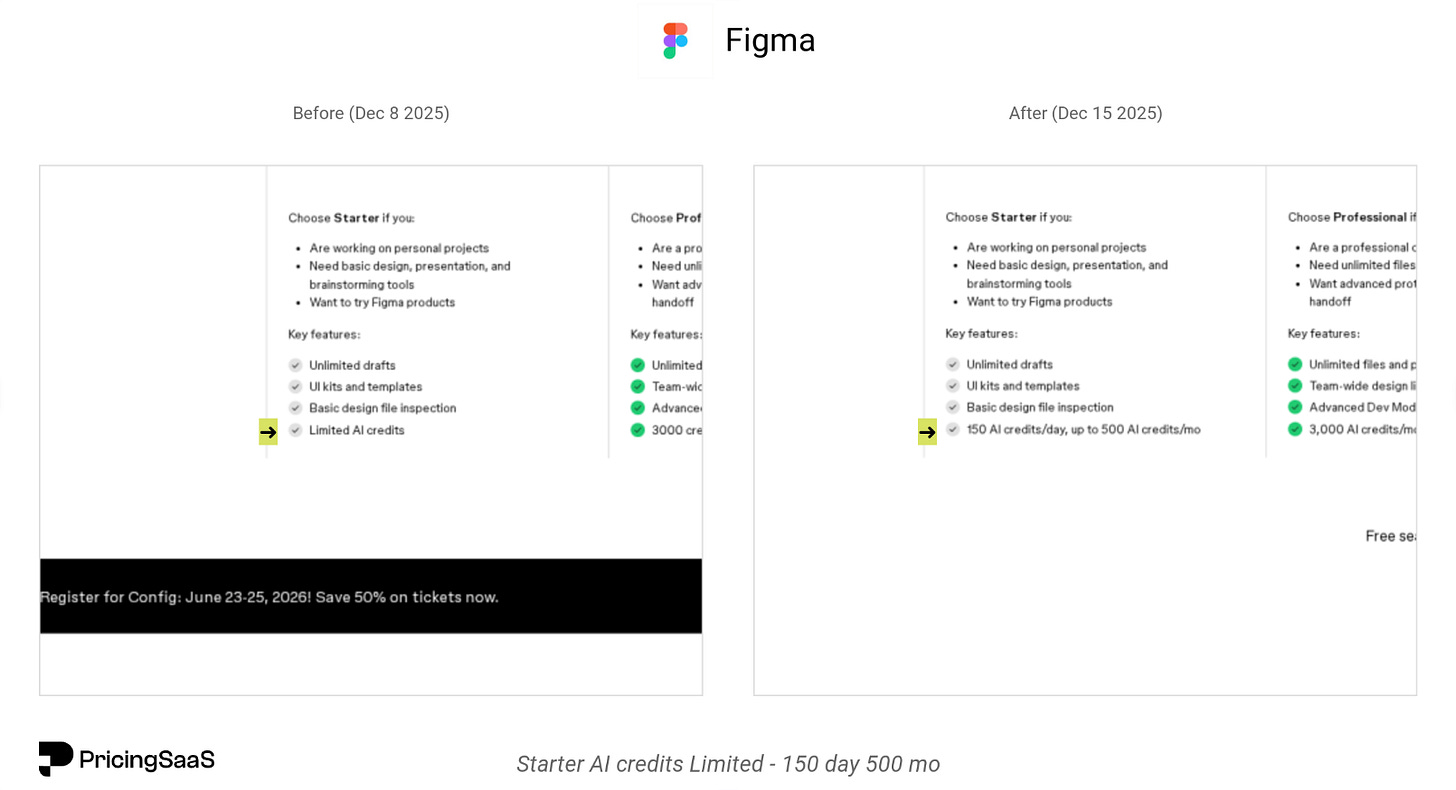

Figma Follows Lovable’s Lead on AI Credits

Last week, Figma updated their pricing page with a notable change: the Starter plan’s AI credits moved from “Limited” to a specific allocation.

The vague “limited” language suggested they were still figuring it out, but now they’re committing to a model, and it looks a lot like the Lovable playbook: a daily cap to drive consistent engagement, paired with a monthly ceiling to protect margins.

Specifically, Figma offers 150 credits/day or up to 500 credits/month. Lovable offers 5 credits/day and 30/month.

Comparing the two is tricky. It’s not apples to apples, and the different scale of their credit values creates some difficult mental math (even ChatGPT was stumped).

Based on what’s published, Figma appears to be pretty generous with the free tier, which aligns with CEO Dylan Field’s commentary in their last earnings call (emphasis added):

During a period where some vibe coding tools are reportedly slowing growth, Figma Make is speeding up. By September, approximately 30% of customers spending $100,000 or more in ARR were creating in Figma Make on a weekly basis, and that number has continued to grow. We will continue investing heavily in AI, and we will trade near-term margin to build the right long-term platform for our customers.

One looming issue that I can’t help but think about here is credit fatigue. When every product has its own credit denomination and consumption rates, comparing value across competitors becomes a job itself. That becomes even more challenging as products converge to offer similar functionality (more on that shortly). I’m already hearing operators say their customers are complaining about credit overload, and even that they prefer seats!

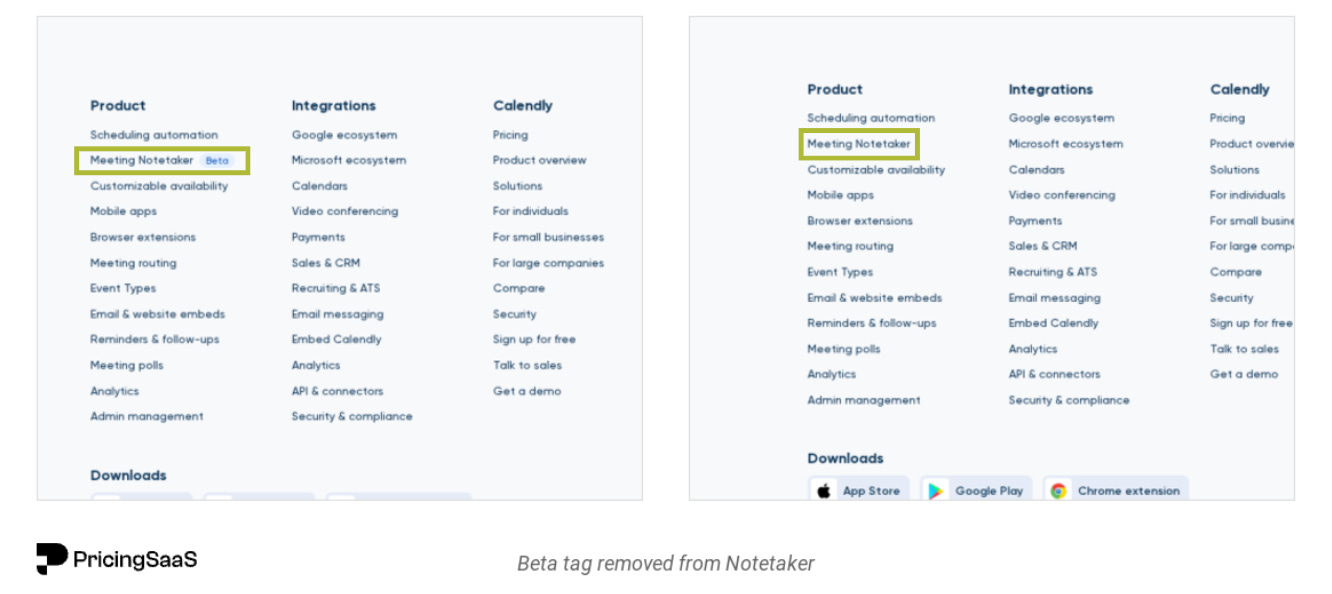

Calendly moved Notetaker out of Beta

Calendly just brought their AI notetaker out of beta. They’re still rolling it out slowly via waitlist, but the signal is clear: they’re serious about this.

Meeting transcripts and AI-generated notes are becoming a fierce battleground for a wide range of apps right now. Just look who’s piling in:

Sales: Gong has been doing this forever, and now CRMs like HubSpot, Day.ai, and Clarify are rolling out their own.

Video Conferencing: Zoom and Teams offer their own versions, while Slack offers AI meeting transcription for Slack huddles.

Productivity: Notion and ClickUp have both added their own AI Notetakers.

Pure Play: Then there are the tools that are purpose built for AI Meeting transcription like Granola, Fireflies, and Read AI.

Why is everyone chasing meeting notes? Because it’s sticky. If you’re the place where someone stores their meeting context: summaries, action items, transcripts, you’ve embedded yourself into their workflow in a way that’s hard to unwind.

We use Fireflies, and haven’t left for the simple reason that its the first tool we tried, it works, and I like being able to search through old meeting transcripts if needed.

For Calendly specifically, this move makes a lot of sense. They’ve been searching for the next product beyond scheduling, and given their proximity to meetings, AI note-taking feels like a natural extension.

I’m curious to see how they price and package this. Do they bundle it into existing tiers? Make it a standalone add-on? Use it as the anchor for a new premium tier? The packaging decision will say a lot about their strategy.

Elsewhere:

Veed stopped offering free AI Video Generation.

Hotjar increased usage limits on the free plan and added new features.

Docusign launched a limited time discount.

Zoom refined positioning for Webinars & Events.

Chili Piper removed the Chat AI add-on (which was $20k per year)

Check out more updates on PricingSaaS →

Thanks for reading! When you’re ready, here’s how we can help:

Community: Answers from real pricing experts. Apply for membership →

Data: Access to news, research, and analysis. Sign up for free →

Advisory: Free pricing advice. Book a 30-minute call →

The credit fatigue observation is on point. I've been tracking this with enterprise buyers since mid-2024 and the friction is real, especially when a team is juggling 15+ SaaS tools all with their own credit economies. The mental overhead of understanding what 150 Figma credits actualy translates to in real output versus 30 Lovable credits is nontrivial. The meeting notetaker convergence is fascinating too bc it shows how commoditized core AI functionality has become, making distribution and product proximity the main moats now.