How 10 SaaS Companies Are Reinventing Seat-Based Pricing

Plus: Updates from UiPath and Podium.

Welcome back to Good Better Best!

We want to know how SaaS buyers want to pay for AI agents — and we need your help. Take 2 minutes to complete this survey. As a thank you, we will happily take a look at your pricing page and offer suggestions to improve it. Just shoot me a note after finishing the survey.

On to this week’s post.

📰 Pricing News & Updates

UiPath introduced new plans.

Podium added price points.

Today’s Post is brought to you by Metronome

Metronome is the world’s leading usage-based billing platform, trusted by companies like OpenAI, Anthropic, and Confluent to launch new products and pricing faster.

Pricing AI products is one of the hardest—and most important—challenges for startups. In this webinar, pricing experts Madhavan Ramanujam and Joshua Bloom of 49 Palms join Metronome CEO Scott Woody to share how startups can outpace the market with smarter monetization.

Learn where to start, how to avoid costly mistakes, and how to build pricing that scales with your product.

The Future of Seat-Based Pricing 🪑

Confession: I don’t think seat-based pricing is dead.

I believe it’s evolving as companies figure out creative ways to define what a “seat” means. Further — in a world where AI fundamentally reduces the number of seats that a company needs, seat-based pricing actually becomes more customer friendly.

We can explore that for another day.

Today I want to share 10 examples of companies that are innovating on traditional seat-based licenses, and proving that a creative approach to seats can still power a winning pricing and packaging model.

Note: This post went too long for email. Click here to read in your browser and avoid the cutoff.

1. OpenAI (ChatGPT): Product Power

OpenAI employs an elegant model where they charge by seat, but each tier provides more product power. Their differentiation includes model quality, response times, context windows, and features like deep research. With each seat upgrade, users gain more power at their disposal—a particularly effective approach for a company with both B2B and B2C use cases.

2. Figma: Product Access

Figma has introduced different types of seats, with each seat granting access to different Figma products.

Collab seats give access to FigJam and Figma Slides

Dev seats give access to FigJam, Figma Slides, and Dev mode in Figma Classic (without design creation capabilities)

Full seats give designers access to everything

These seat types can be utilized across any of Figma's plans (Professional, Organization, Enterprise), with scaling costs for each seat type within each plan.

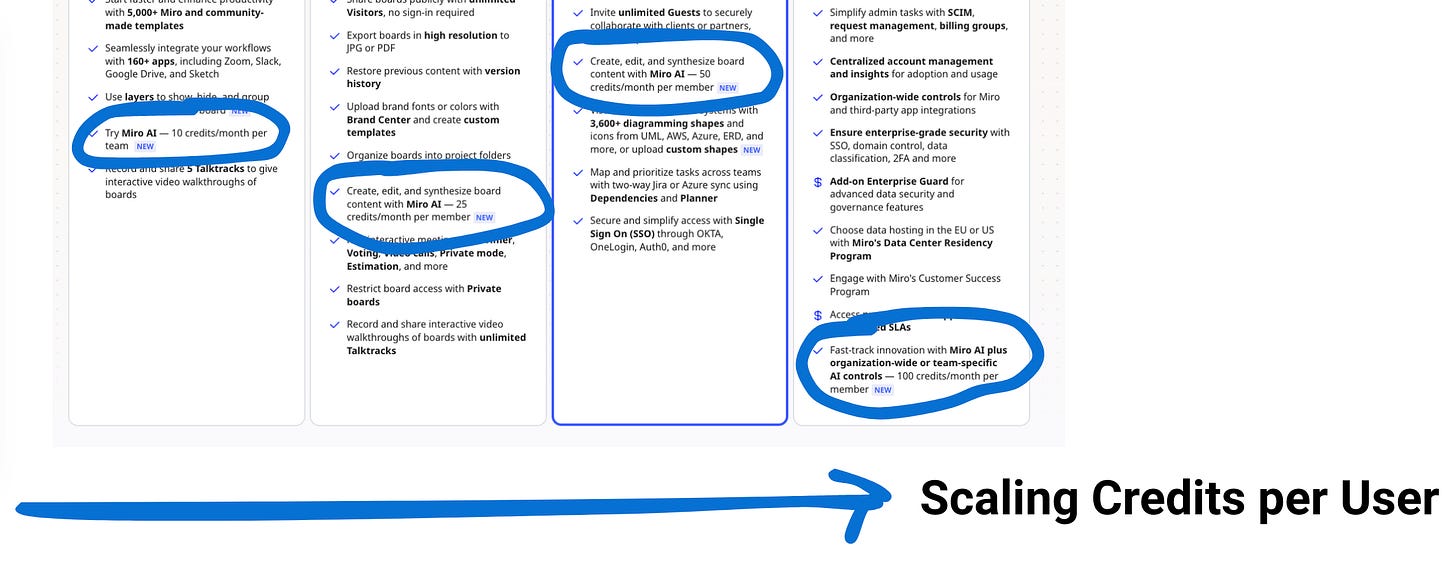

3. Miro: Scaling AI Credits

Miro has woven AI credit limits into their seat-based pricing model. This creates compelling reasons to upgrade for users who are getting significant value from Miro AI, effectively combining seat-based pricing with usage thresholds.

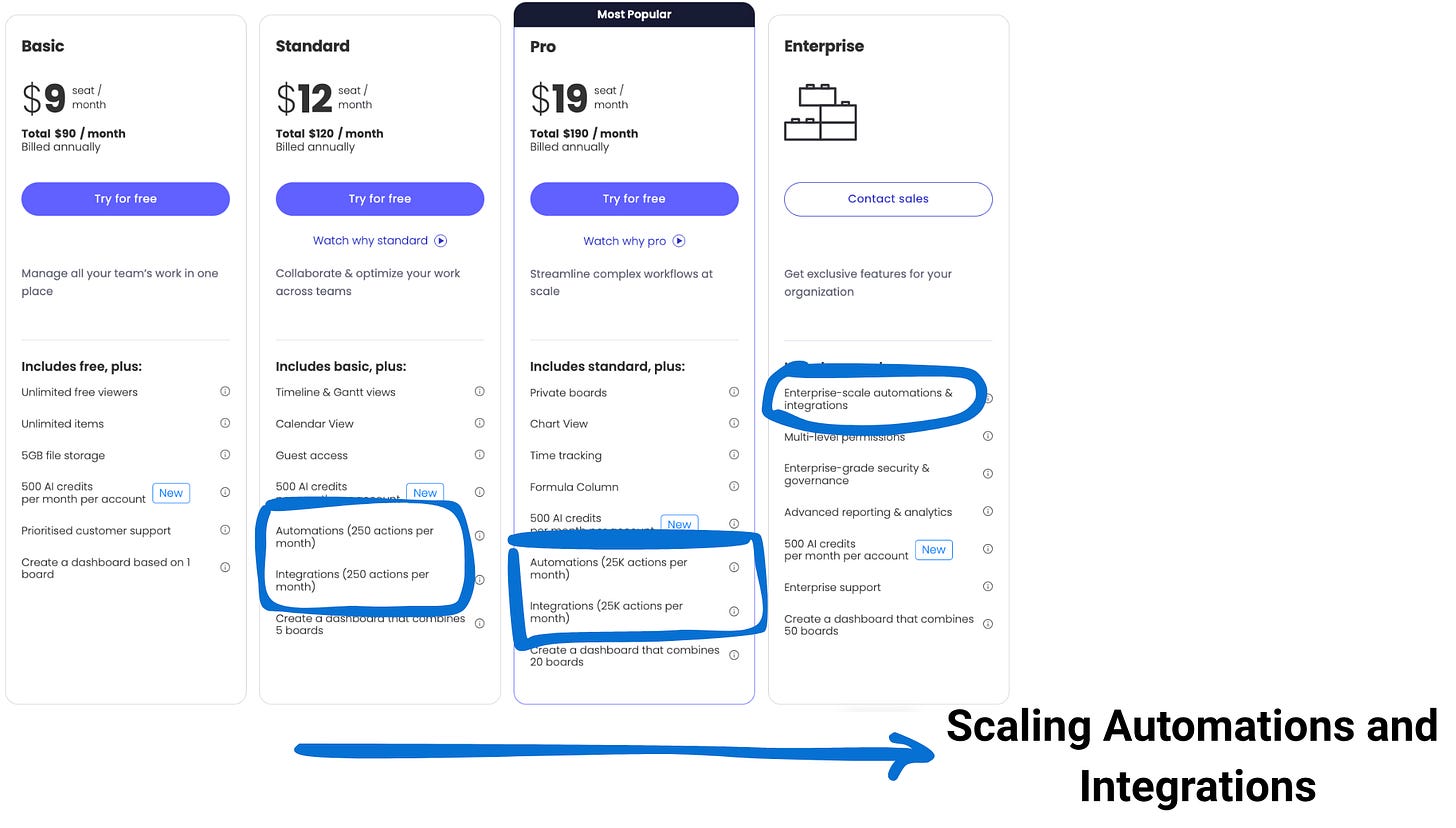

4. Monday.com: Scaling Automations

Monday is implementing a similar approach with automations and integrations. With each tier upgrade, users receive more automation and integration capabilities. This represents a shift towards outcome-based pricing within their existing seat-based model.

5. Okta: Scaling Product Access + Workflows

Okta recently shifted from an à la carte pricing strategy to a good-better-best approach with four plans: Starter, Essential, Professional, and Enterprise. Each subsequent plan offers more Okta products bundled into packages, along with more workflows. Intuitively, the more Okta products you’re using, the more workflows you likely need — creating a compelling narrative for customers as they grow.

6. Chili Piper: In-Plan Add Ons

Chili Piper offers "in-plan add-ons" that ladder up to their seat-based model. While customers pay a per-user fee for base products like Concierge and Handoff, add-ons like Concierge Live and Handoff Live come with platform fee minimums. This strategy increases average contract value, while pushing Chili Piper’s value further down the value chain from inputs to outcomes.

7. Notion: Platform Add-On

Notion implemented an AI add-on that works across their entire platform. Adding the AI toggle increases the monthly price on all plans by $8 per seat per month. This simple approach gives users the option of standard Notion functionality or the full AI experience at a premium. It also cleverly monetizes their freemium plan.

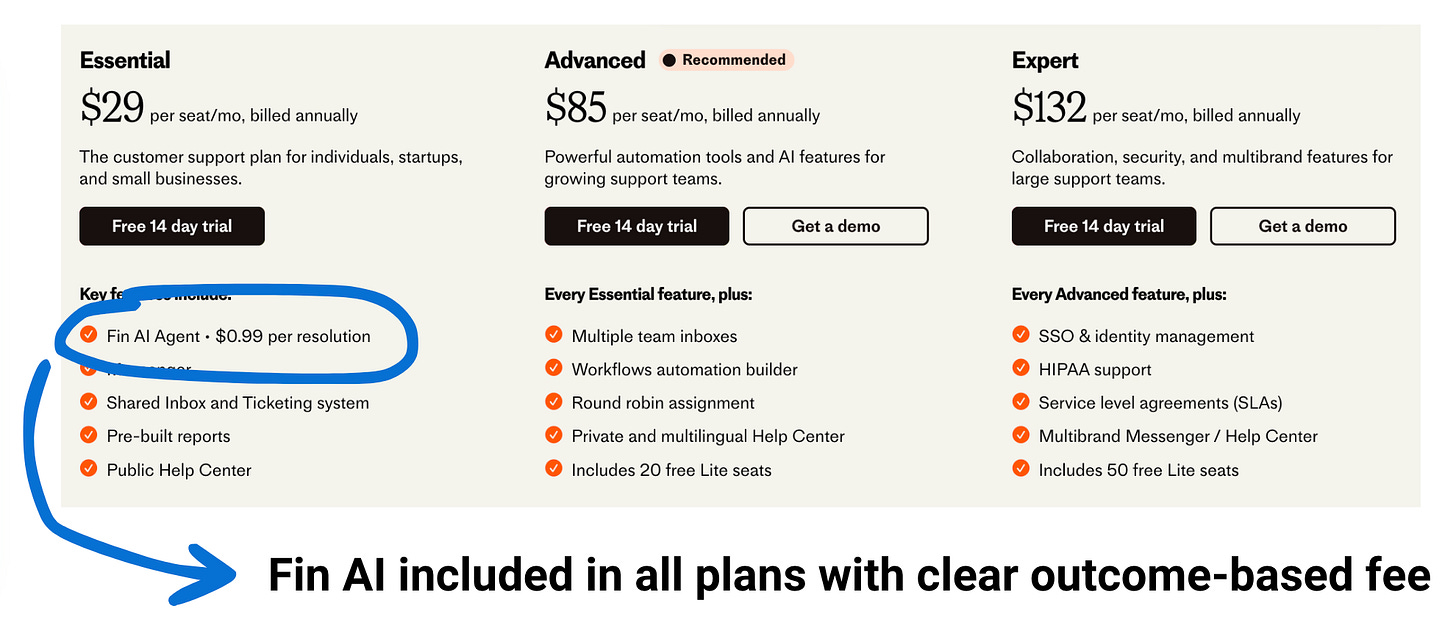

8. Intercom: Outcome Based Add-On

Intercom offers their well-known AI agent, Fin AI, as an add-on to their seat-based pricing. With all tiers, customers can add Fin AI for a flat rate of $0.99 per resolution. While Intercom is pushing agentic pricing forward, they're still using a seat-based model—demonstrating that innovative AI pricing and traditional seat-based approaches aren't mutually exclusive.

9. DocuSign: Verticalized Plans

DocuSign created a verticalized plan specifically for real estate agents—a brilliant strategy that created a tailored version of their eSignature product for a highly engaged market. This verticalized strategy opened up new marketing opportunities for this persona while maintaining their existing plans for more horizontal use cases. More SaaS companies should probably consider this.

10. Superhuman: Jobs to be Done

Superhuman employs a tiered packaging model with three tiers, each focused on a clear job to be done. This structure makes it easy on the buyer: most individuals choose the starter plan, GTM professionals choose the Business plan, and organizations opt for the Enterprise tier.

Looking Ahead

Will new pricing models continue to arise? Of course. Will there be less companies charging per seat? For sure. Will seat-based pricing go away entirely? I’m skeptical. These examples show how some of the top players in SaaS are getting creative with seat-based models to make them relevant for the modern buyer.

🎯 Expert Insight

When I started developing pricing strategies for SaaS companies, I quickly learned that seat-based license models were considered the gold standard. They're classic, common, and seemingly straightforward. But after years of implementing and refining these models, I've come to a more nuanced understanding.

At its core, a user license is simply a right to use something. What makes it powerful is its predictability - it's a recurring charge where customers decide upfront how many users they need. This creates stable, foreseeable revenue streams for SaaS businesses. However, the simplicity that makes this model attractive also creates significant limitations.

Let me break down what I've learned about user-based pricing:

Simple doesn't mean effective. While a basic price-per-user model requires minimal calculation effort (perfect for an MVP), it's surprisingly poor at discriminating between different customer segments. The same linear pricing rarely works for both small businesses and enterprise clients.

Complexity is your friend. As your Average Contract Value increases, you need to add complexity to enable proper price discrimination. This might involve flat fees creating de facto volume discounts or implementing tiered pricing models. Don't fear complexity - embrace it strategically.

Position in the value chain matters. For many products, users represent an investment input rather than the desired outcome. Customers don't inherently want more users; they want the results those users create. This positioning at the "input end" of the value chain means customers initially minimize user purchases, creating longer expansion cycles.

Leverage familiarity. One significant advantage of user-based pricing is high "Expectation to Pay" - customers are accustomed to paying per user for software. This established habit creates a perception of fairness that other pricing models might lack.

Watch your metric density. If a large proportion of licensed users aren't actively using your software, you've got a low-density pricing metric. In such cases, consumption-based alternatives like Monthly Active Users might better align with the actual value delivered.

Build around it, don't rely solely on it. User-based pricing works best as the core "fair value metric" that establishes a baseline. For larger customers, it needs support from other metrics, flat fees, and service charges to defend against negotiation pressure and cover your costs.

My work with customers has consistently shown that when a simple user-based model fails, it usually signals deeper misalignments with how customers perceive value, structure their budgets, or integrate the solution into their workflows.

In the end, effective pricing isn't about selecting a single perfect model but crafting a comprehensive architecture that aligns with your customers' perception of value and your business strategy. User-based pricing remains valuable, but it's rarely sufficient on its own beyond the early stages of growth.

If you’re looking to dig deeper into pricing models, I did a webinar a little while back explaining how I think about it.

How we can help when you’re ready

Got questions? Join the free PricingSaaS Community to get fast answers from pricing leaders.

Leveling up? Check out our Resource Center for links to pricing and packaging research, webinars, and our free online course.

Need help? Our SaaS Pricing Assessment delivers a clear roadmap to smarter pricing and packaging in 30 days.